GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Are you wasting too much time and money only to keep your books straight?

You are not alone. Many of the companies in Canada, particularly small to medium-sized businesses, are finding it difficult to cope with the stress, increased operational costs, staffing issues, along with the constantly changing needs of financial compliance. Keeping an in-house accountancy department at the premises usually translates to salaries, software costs, recruitment troubles and yet, the process is stalled.

This new world of business is not about going on with less, but doing more with less. It is the reason why there is an increasing rate of Canadian accounting firms that are resorting to outsourcing accounting services as a cost-effective and scalable solution. In addition, accounting outsourcing saves money, introduces access to qualified experts, accelerates reporting periods, and provides more financial management control.

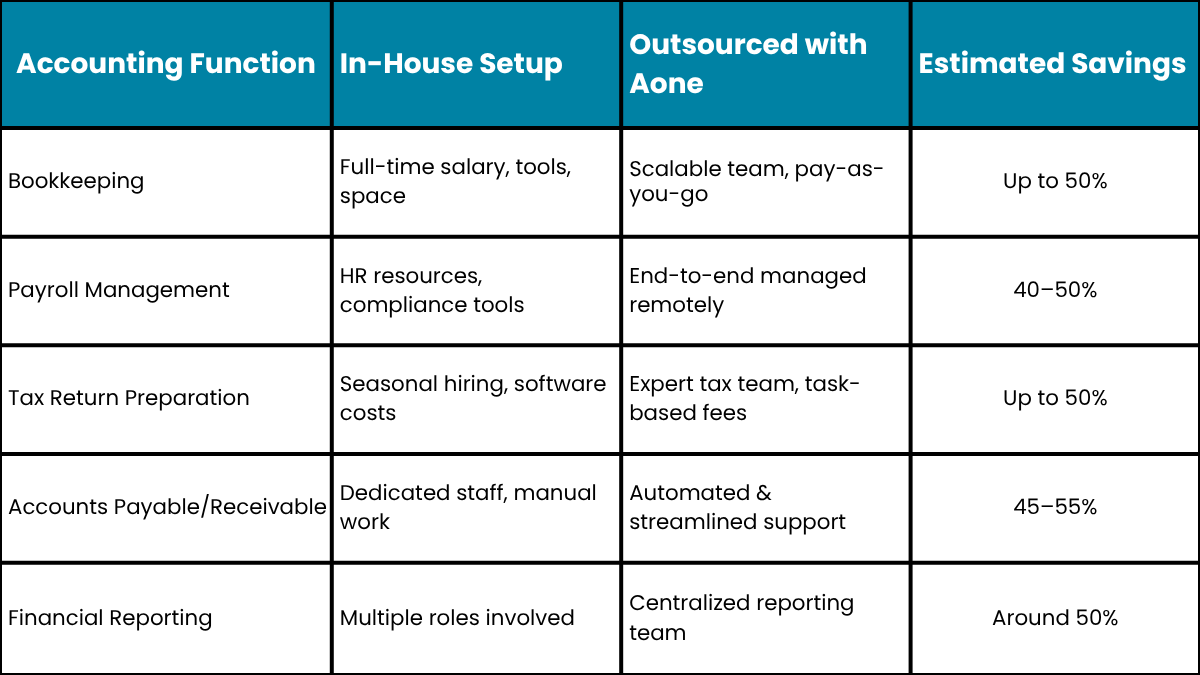

When a company has the right outsourcing partner, cost reduction by up to 50% is realized, not at the expense of quality or compliance. There is no more working on the cheap; it is working lean, maintaining competitiveness and paying attention to what makes the difference.

Outsourcing of accounting refers to the process of contracting an outside service provider to perform all or part of the accounting and bookkeeping work you have in your business. Rather than employing an in-house accounting team full-time, the businesses outsource their accounting duties, including bookkeeping, payroll management, tax payments and reporting, and financial statements, to a third-party contractor, usually overseas.

The strategy enables companies to lower the cost of running operations as well as boost productivity and tap into the pool of competent financial experts without necessarily having to incur recruitment, training and infrastructure expenses. It is a smart method of being in compliance and financial order, and keeping internal resources concentrated on the main business development.

The Canadian market is increasing steadily in demand for outsourced accounting services, and that too with its reasons. The various businesses in different industry realms are coming to terms with the fact that in-house accounting has its limitations, which could be addressed through outsourcing.

There is a persistently high demand and an inflationary pressure in the labour market in Canada, particularly in competitive areas such as finance and accountancy. Operation costs are increased by salaries, benefits, training and recruitment. Outsourcing is a sure method of containing costs without sacrificing expertise.

The supply of quality accountants in Canada is narrowing, especially during peak tax seasons or end-of-year closures. Smaller companies and start-up companies are unable to sustain and scout out experienced talent. In outsourcing, one can always have a pool of experts on call and therefore ensure that the company maintains smooth operations even when most of the year is busy.

The modern business needs flexibility - to expand the operations, launch new services or to work through updates of compliance. Outsourced accounting services are cloud-based, tech-based, scalable and permit work-anywhere. Having access to the real-time dashboards, automation, and AI-powered insights, Canadian companies no longer have to be subjected to the restrictions of the traditional accounting departments.

Outsourcing in Canada will help companies become cost-efficient, more agile, and financially smarter, all of which is necessary in competition in the contemporary market.

The cost savings in the case of outsourcing accounting services are not only hypothetical; it is achievable and large. Canadian firms, on average, are also able to cut their accounting expenses by up to 50% by either outsourcing core functions to a trustworthy offshore partner. It is not only about the difference in salaries but also about getting rid of a plethora of invisible expenses connected to in-house work.

Look at the following table, going over a brief analysis of the differences between typical in-house and outsourced accounting that are comparable:

Outsourcing not only minimizes the direct services cost, but also the service fees charged by Freelancer that most companies fail to count, including but not limited to:

Hiring & onboarding expenses

Pensions and benefits of the employees

Office space, hardware, and software costs

Retention and training programs

Turnover losses or absenteeism losses

That is, outsourcing not only saves your internal teams' time and resources but also enables them to direct their efforts at strategy, expansion, and building relationships with clients, without having to deal with operational stumbling blocks.

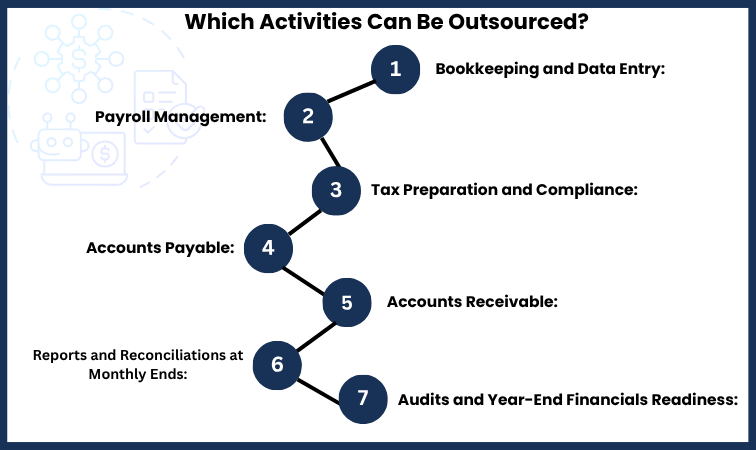

Outsourcing does not only concern the basic keeping of books, but it spans a broad agenda of accounting responsibilities that your business cannot do without. Such activities are sometimes repetitive, time-consuming, and process-oriented, which fits appropriately in outsourcing without loss of accuracy or control.

The following are the most common accounting activities which Canadian businesses outsource:

Keep a running record of transactions made, revise ledgers and keep your financial records current at all times.

Seek employee pay in process, withhold tax, payroll remittance and also generate reports in observance of Canadian community and revenue agency regulations.

Filing of corporate tax, personal tax, and managing GST/HST filings, as well as meeting the statutory deadlines.

Monitor tracked invoices, plan payments, take care of communication with the vendors, and stay out of late fees or lost discounts.

Create and issue invoices, track incoming payments and chase outstanding balances.

Make profit and loss statements and balance sheets, and do proper bank and ledger reconciliation.

Collect all the documents required, working papers, and final statements to be audited, and financial statements closed with the external bodies.

When you outsource these activities, you not only liberate some internal capacity, making your turnaround times shorter, but you also get access to these specialized resources, all while reducing your overall accounting spend.

Outsourcing has much more to give than cost reduction. And when implemented well, it has the potential to transform the way your accounting function operates, by releasing value at any given level across your business. Here’s how:

The fastest one will be a large decrease in operating expenses, as much as 50%. Businesses are able to divert capital to drive growth programs without being burdened with high costs of compensation, benefits, installation of office infrastructure, and training.

In an outsourcing company, the workflow and high volume processing require well well-streamlined work method with a staff team that specializes in high-volume processing. This results in reports generated within a shorter period, reconciliations made within the least time and a lean month-end closing period even when busy.

When you outsource, you get into an environment where you get a pool of people who are specially trained in accounting, tax compliance and the industry's best guidelines. This saves the mistakes, creates regulatory congruency, and makes you feel certain about your monetary statements.

The management of seasonal accounting spikes is one of the greatest pains that this has addressed among Canadian firms. Outsourcing enables scaling services upwards and downwards as and when needed, and there is no need to hire and strain internal teams.

Your internal team is able to work on planning, forecasting, client interaction and decision making, which are the events that will drive your business in a positive direction, instead of doing the routine accounting work on it.

Outsourcing may be a clever step, however, only in case you choose the right provider. Before switching to it, you should pay attention to the following points:

Choose a provider with Canadian accounting expertise: Your partner should be familiar with the GAAP, CRA compliance, GST/HST regulations and other domestic rules. This will make your books accurate and audit-ready.

Ensure strong data security and privacy policies: Seek companies which follow international requirements (such as ISO) and regional requirements, including PIPEDA. The encryption and firewalls, and access controls have to be used on your financial data.

Assess communication and workflow integration: An effective working relationship also relies on good communication channels, common project management tools and easily accessible reporting dashboards. Enquire on how real-time updates, queries and reviews will be managed.

Look for scalability and proven results: Your outsourcing service provider must be capable of expanding together with you. Look out to see client success stories, service flexibility and their capability to accept a complex task as your business is growing.

The consideration to review such aspects is because it is not only important that your outsourcing will be cost-effective, but be strategic and sustainable as well.

Accounting outsourcing is not only a means of cutting corner costs but as a long-term model of growth, accuracy and efficiency. The benefits are obvious (saving costs, flexibility in operations), and Canadian businesses have already switched to it.

Aone Outsourcing has committed itself to offering specialized outsourcing accounting services to businesses within the Canadian market, which would reduce their expenses by up to 50 percent and still ensure the best quality and compliance. That makes us confident to become your smart accounting partner with proven performance, experienced teams, and secure systems.

Book your free consultation with Aone Outsourcing today! Join us in creating a leaner and more profitable future.

Contact Us Email Us Call UsRecruiting a full-time accountant in Canada will set you back between CAD 50,000 and CAD 80,000 a year, depending on the experience and place of work. The prices that freelance or part-time services are usually CAD 50 to CAD 150 per hour. The other expenses, such as benefits, training and software subscriptions, may compound and increase the cost of in-house accounting in small to mid-sized businesses.

Outsourcing saves money since there are no full-time salaries to meet, benefits, and an office to house, as well as recruitment costs. The offshore accounting providers are also competitive in price, usually by 40-50 percent, and offer no accuracy or compromise on compliance. Moreover, outsourcing is a very cost-efficient approach to problems since businesses do not experience downtimes and simple to operate become more efficient due to outsourcing.

Outsourcing is a legal business and a common practice in Canada in most industries, including accounting. Nevertheless, corporations should be able to guarantee that acts governing data privacy, such as PIPEDA (Personal Information Protection and Electronic Documents Act), are adhered to everywhere sharing secured information on finances or personal information with a third-party provider, provider-especially those offshore.

Yes, accounting is an occupation that is in high demand in Canada, especially because of the growth of businesses, regulations, and even the cycle of paying taxes. Due to a continuous lack of qualified accountants, especially in the smaller cities and during busy periods, most businesses are resorting to hiring outsourcing accounting firms to fill the talent gap as efficiently as possible.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .