GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

It starts slowly. A few unopened envelopes. An ignored CRA email. Then one day you log into your bank account, and something's off. A refund you were counting on? Gone. A balance you didn’t expect? Growing. And that harmless “reminder” from the Canada Revenue Agency? It’s now a final notice with interest accumulating daily.

Welcome to tax season in Canada — not just another bureaucratic routine, but a financial battlefield that decides whether you win with a refund or lose sleep over penalties. The 2025 tax filing deadline may look distant on paper, but for millions of Canadians, it’s the single most important date on their financial calendar.

Every year, the CRA processes over 33 million income tax and benefit returns, and behind every one is a story of missed deductions, unclaimed benefits, forgotten slips, late filings, and penalties that could have been avoided. The difference between stress and strategy? Knowing what to do and when.

So take a deep breath — because this blog will walk you through every single thing you must know before the 2025 tax deadline hits. Whether you're an employee, student, gig worker, or business owner, this is your no-fluff, complete guide to staying compliant, maximising refunds, and avoiding CRA's iron fist.

The standard tax filing deadline for most individuals in Canada is April 30, 2025. That means your 2024 income — from full-time jobs, side hustles, rental properties, investments, or government benefits — must be reported by that date.

But here’s the trap: April 30 isn’t the day to start worrying. It’s the day everything must already be submitted, accurate, and paid. And if you’re self-employed or have a spouse who is, your deadline to file is extended to June 15, 2025 (or June 16, since the 15th is a Sunday), but you still need to pay by April 30 to avoid interest.

The CRA officially opens online filing on February 24, 2025, and if you’re ready, this is your window to file fast and get your refund early. On average, over 19 million Canadians received refunds in 2024, with $2,294 per return.

But here's the terrifying reality: Many Canadians wait for all their slips, only to realise too late that something is missing, a T4, T5, T4A, or RRSP receipt. Then they either:

Use the CRA’s Auto-fill My Return tool (through certified software) to import your slips directly. No more waiting for the mail, the CRA already has most of your documents. You just need to connect the dots.

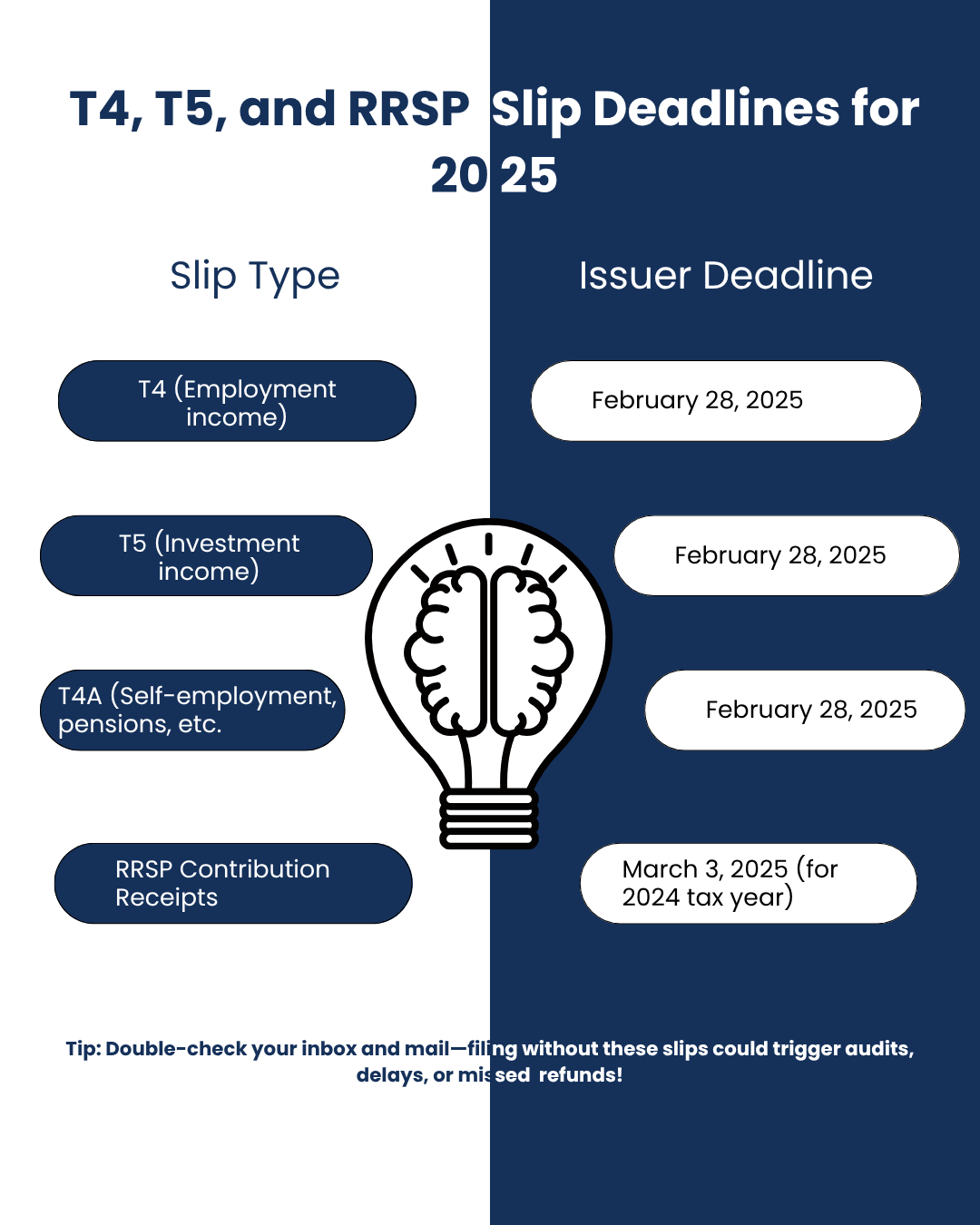

Here’s when your financial puzzle pieces must arrive:

|

Slip Type |

Issuer Deadline |

|

T4 (Employment income) |

Feb 28, 2025 |

|

T5 (Investment income) |

Feb 28, 2025 |

|

T4A (Self-employment, pensions, etc. |

Feb 28, 2025 |

|

RRSP contribution receipts |

Mar 3, 2025 (2024 tax year) |

If you're missing slips by early March, don’t sit back. Contact employers or log into CRA My Account to retrieve them. Filing without them invites CRA audits, reassessments, and refund delays of months.

Mistake alert: Forgetting one T5 from a $900 savings account may seem minor—until CRA finds it and slaps a 20% penalty for unreported income.

Every year, thousands of Canadians make the same simple mistake: they rush to file their return before all their income slips arrive. Maybe it’s a forgotten investment T5 from a rarely-used savings account, or a small T4A from a one-time freelance gig. Maybe it's an RRSP contribution receipt that slipped behind a pile of unopened envelopes. And just like that, a refund turns into a reassessment.

This is where the real danger lies. The CRA now has advanced data-matching algorithms that compare your filed return with the slips they’ve already received from banks, employers, and institutions. If your return is missing just one of those slips, even a small one, it triggers a mismatch. What happens next? A reassessment notice, interest charges, and in some cases, a permanent red flag on your file. Let’s be real — most people don’t intentionally leave out slips. They either:

But the CRA doesn’t grade you on intention. It responds with penalties and interest. And if you’ve made similar mistakes in the past, you could be subject to gross negligence penalties, which are up to 50% of the understated tax.

Here’s what you need to do:

|

Real-world example: Rachel, a part-time barista and Etsy seller, received a T4 for her coffee shop job, but forgot about the T4A issued by an online course platform she worked with briefly. She filed in early March, got a refund, and spent it. In July, the CRA caught the missing T4A. She was reassessed, had to repay the refund with interest, and lost eligibility for some benefits next year. Don’t be Rachel. Wait for every slip. Then file smart. |

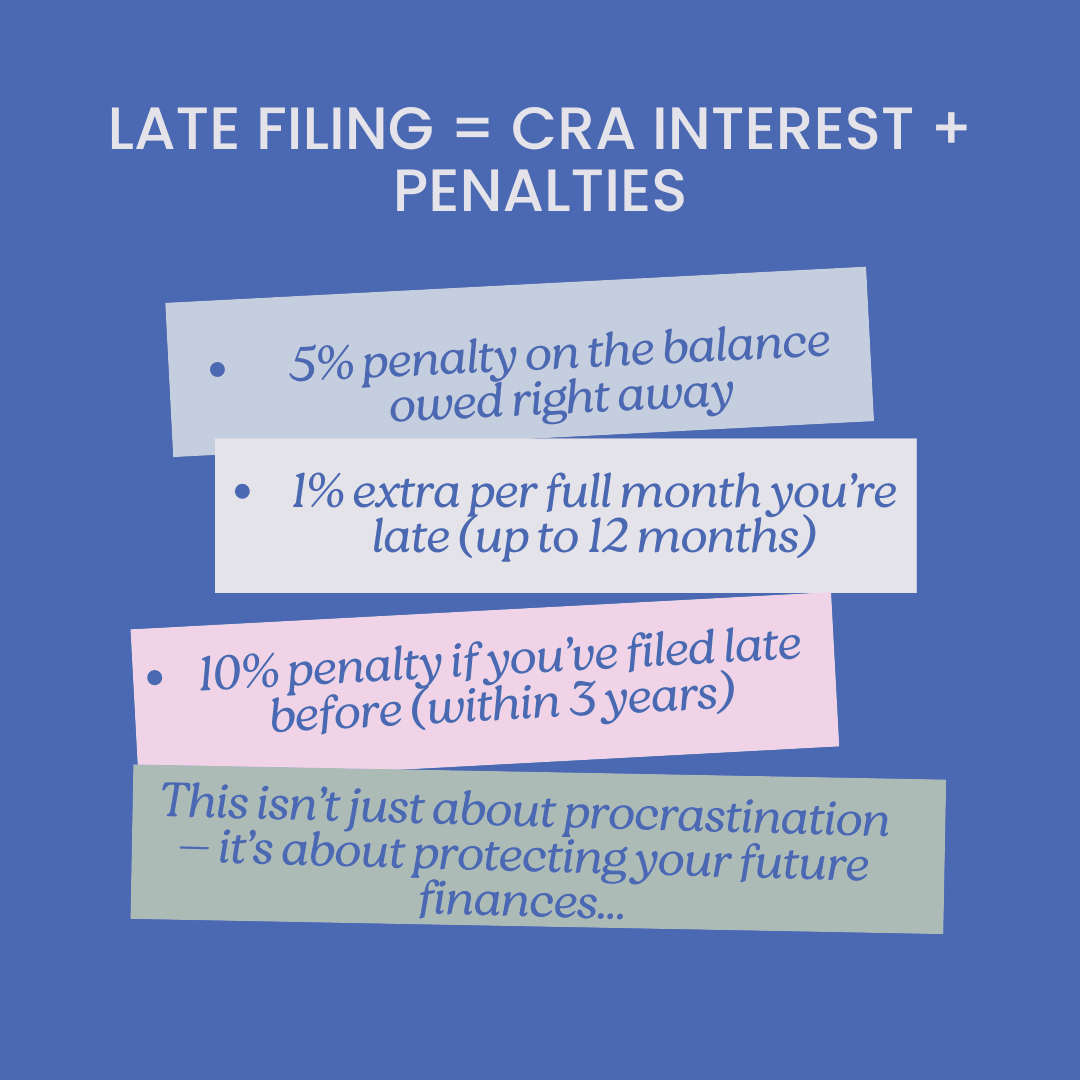

Filing your taxes late in Canada is more than a minor inconvenience. It’s a fast track to financial penalties, mounting interest, and even withheld benefits. And if you owe money, the punishment grows by the day.

Let’s walk through what really happens if you miss the April 30, 2025, deadline.

Day 1 — May 1, 2025: The CRA immediately charges you a 5% penalty on your unpaid tax balance. No grace period. No second chances. And for each full month your return remains unfiled, they tack on an extra 1%, up to a maximum of 12 months. That’s a total penalty of up to 17% — before interest even begins.

Day 31 and beyond: Interest starts compounding daily on both your tax debt and the penalty amount. It doesn’t stop until the full balance is paid. If you’ve ever been late before — within the past three years — the CRA doubles the penalty to 10% upfront + 2% per month, maxing out at a jaw-dropping 34%.

And it doesn’t stop at penalties.

Remember: Even if you can’t pay the full amount, you MUST still file on time. Filing late + owing money is the most expensive mistake you can make.

Many self-employed Canadians breathe a sigh of relief when they hear they have until June 15, 2025, to file their taxes. But this sense of comfort is a trap. Because while you may have until mid-June to submit your return, you still have to pay any taxes owing by April 30 — the same deadline as everyone else.

This is the CRA’s little-known catch: they extend your filing window, but not your payment deadline. And if you don’t pay by April 30? You’re hit with daily interest starting May 1, even if you haven’t filed yet.

This affects more people than you think:

Self-employed returns also require extra care. You’ll need to report business income on Form T2125, document your expenses properly, and calculate GST/HST if you’re registered. It’s not just an extra form — it’s a full mini-tax return within your return.

Pro Tip: To avoid interest, estimate your taxes early (using last year as a baseline if needed), and make a payment to the CRA by April 30 — even if it’s not exact. It’s better to slightly overpay and get a refund than underpay and be charged retroactive interest.

When tax season hits, the difference between smooth sailing and a financial nightmare often comes down to one thing: the right partner. Aone Outsourcing Solutions isn’t just another accounting service — we’re your proactive ally in navigating CRA compliance, deadlines, and deductions. Here’s why thousands trust us to file their taxes right — the first time.

From entrepreneurs and freelancers to small business owners and large firms, we understand the nuances of Canadian tax law, no guesswork, no generic filing. Whether it’s T4s, T5s, GST/HST, or self-employed deductions, our accountants are well-versed in every rule and exception that could save you money.

Aone’s systems are designed to ensure zero missed deadlines. Our proactive reminders, automated calendars, and early document reviews mean we’re ahead of the CRA’s clock. We take the pressure off you and your team, ensuring every slip and return is filed before the cut-off.

We don’t just file returns, we future-proof them. Every document prepared by Aone meets strict audit readiness criteria. If the CRA ever knocks, you’re covered with organized, defensible records.

From notice of assessments to relief applications or clarification requests, we deal directly with the Canada Revenue Agency (CRA) so you don’t have to. Our clients never waste hours on hold or risk miscommunication with tax authorities, we speak their language, literally.

Whether you're preparing for the April 30, 2025 tax filing deadline or already planning for 2026, we’re with you every step of the way. Our ongoing compliance support keeps your finances CRA-ready year-round.

Need one-time filing? A full-service annual partner? Bookkeeping + tax returns + payroll? We customize our services based on your complexity, budget, and business goals. No overpaying, no under-delivering.

|

Pro Tip: Want peace of mind beyond April 30? Our “Full-Year Tax Care” plan includes quarterly check-ins, CRA correspondence handling, and unlimited support. |

Missing your tax deadline can result in late-filing penalties of 5% of your balance owing, plus 1% for each month you're late (up to 12 months). Interest also accrues daily. Even if you can't pay right away, file on time to reduce penalties.

You can file your 2024 taxes as early as February 24, 2025, once the CRA opens the electronic filing system. If you're expecting a refund or benefits, filing early helps you receive them faster.

You can still file on time and work out a payment plan with the CRA. In some cases, CRA relief programs may apply if you’re facing financial hardship or emergencies. Aone can help you assess eligibility and apply on your behalf.

As of now, yes:

Absolutely. We specialise in tax cleanup and back-filing. We’ll communicate with the CRA, request interest relief where possible, and help you regain full compliance, stress-free.

Yes. Even if you have no income, filing helps you stay eligible for benefits like GST/HST credits, the Canada Child Benefit (CCB), and provincial support programs. It’s always worth filing.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .