GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

In 2025, the business climate in Canada is undergoing rapid changes, driven by hybrid work patterns, economic shifts, and an increased reliance on digital infrastructure. Whether it is fast-growing start-ups or established businesses, companies are striving to become more tech-savvy and transition to accounting systems that are more scalable to accommodate growth. To a large extent, this demand is driven by Millennials and Gen Z business owners, who are replacing outdated, manual accounting processes with agile, automated, and insight-driven ones.

In the meantime, accounting firms and CPA practitioners can address the new pressures. Increased operating expenses, a shortage of talent, and high client expectations are compelling firms to redesign traditional service delivery. Outsourcing accounting in Canada (2025) has already been adopted by many, in the hope that it can serve as a strategic response not only to contain costs but also to drive efficiency and future-proof their practice.

With the help of CPA outsourcing services and secure cloud accounting services in Canada, companies gain access to specialized expertise, process automation, and 24/7 support. There were further advantages of real-time reporting and CRA-compliant practices made possible by outsourced accounting services in Canada, which is no longer a luxury but a necessity. This can be observed in various areas, including payroll, financial statements, and tax preparation. There are strong reasons to believe that outsourced bookkeeping advantages readers, suggesting a transformation in bookkeeping is likely to occur in 2025 and beyond.

A silent revolution is underway in Canada's accounting landscape. By 2025, additional companies and entrepreneurial businesses are expected to shift to remote and cloud-based accounting platforms to ensure smooth operations and remain flexible. Not that the switch to convenience alone is strategic, but rather a means to counter the increasing costs, talent shortages, and need for quicker turnaround times.

Due to the pressures of inflation and the high cost of their skilled in-house workforce, many Canadian companies are seeking a solution that does not compromise quality. The businesses that provide outsourced accounting services are filling this gap, offering reliable, efficient, and scalable support in all financial activities.

Accounting firms, particularly those serving small to mid-sized clients, will find this transition to an alternative channel essential to remain competitive and balance internal capacity. By utilizing cloud accounting services in Canada, companies can centralize data, enhance collaboration, and provide timely financial information to meet the needs of this generation of clients.

Geographical constraints are also avoided through the use of outsourced accounting services in Canada, allowing firms in Ontario, Alberta, or British Columbia to access international talent without compromising on local requirements. Such contemporary accounting applications align well with the forward-looking attitudes of modern companies.

It should not be surprising that benefits of outsourced accounting gained more popularity in 2025, especially considering the busy Canadian SMEs and CPA practitioners who had to handle an increased workload. Bookkeeping functions, such as reconciliations, transaction tracking, and data entry, are being outsourced as financial complexity increases, to streamline processes and ensure accuracy in day-to-day execution.

Outsourcing has helped small business owners complete their critical work on time and within the CRA's guidelines, without the need for a full-time team. For CPA firms, outsourcing bookkeeping enables in-house employees to focus on higher-level services, such as cash flow forecasting, advisory services, and tax planning.

The latest cloud accounting services in Canada help facilitate this change. As automated platforms eliminate the need to repeat processes, companies benefit from having access to data in real-time, a reduced number of mistakes, and improved efficiency. Such automation and qualified support cannot be matched in terms of accounting services, as they play a central role in encouraging expansion and enhancing the quality of services for firms.

Finally, CPA outsourcing services, which include bookkeeping features, help firms maintain competitiveness, flexibility, and profitability by providing not only financial savings but also a significant growth advantage in a competitive market.

In the Canadian market today, outsourcing accounting services in Canada (2025) is being viewed by firms and business owners as a feasible solution to reduce operational expenditures and costs, address staffing shortages, and mitigate digital disruption.

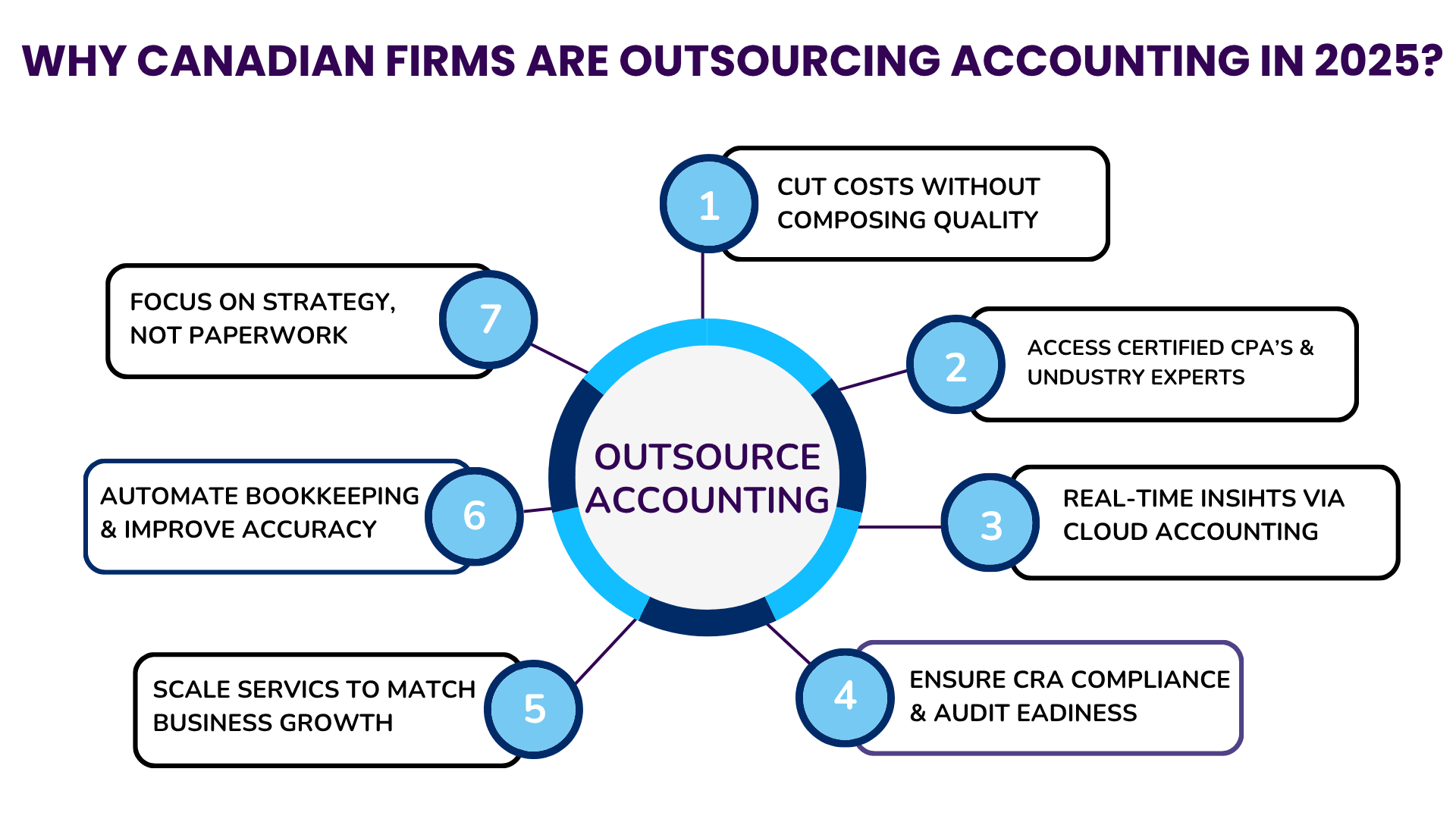

Now, what are the top reasons why this has started to happen, and why are even more accounting firms in Canada now turning to outsourced accounting services to have a competitive advantage?

Outsourcing is helping organizations reduce overheads as inflation and staff wages rise throughout the provinces, ensuring that the quality of services is not compromised. You do not have to spend the money on staffing, training, and supervising full-time accounting personnel.

Outsourcing CPA services allows firms to pay only for the required levels, such as end-of-year reports or everyday bookkeeping, as flexible engagement models are available. It is an affordable business that promotes intelligent, scalable development.

Attracting and retaining skilled professionals in the field of finance within Canada has become a reality. Outsourcing does not involve any recruitment problems, as it provides immediate access to well-trained experts and specialised knowledge beyond the industry.

Companies can become more accessible to niche accounting solutions without spending years on the onboarding process, thereby increasing efficiency and the quality of services.

The use of cloud platforms has emerged as a backbone of the current financial management. Using cloud accounting services within Canada, businesses and customers can access their financial information securely, anywhere and at any time.

The anytime-anywhere visibility is an excellent addition to its overall benefits, including faster forecasting, reporting, and more collaborative client relationships. Hence, it is one of the most useful outsourced bookkeeping advantages.

It requires current knowledge to remain compliant with the Canada Revenue Agency (CRA), particularly given that tax laws tend to change frequently. Firms that outsource their accounting services in Canada are furnished with the aid of experts who concentrate on regulations specific to Canada and Canadian GST/HST requirements and provincial tax peculiarities.

This minimizes risk and bolsters audit preparedness, and is on schedule in all the filings.

Transactional activities consume excessive resources of the in-house teams. Outsourcing eliminates laborious procedures, enabling CPAs to deliver advisory services, establish client relationships, and provide financial planning.

Such high-profit products can help companies increase their income, attract high-quality customers, and redefine themselves in the direction of strategic partners, not just calculators.

Whether it's tax season rushes or new business clients in the corporation, outsourcing accounting in Canada (2025) allows companies to scale up or down the services conveniently. This kind of agility is essential for expanding companies and those operating in various industries.

The ability of outsourced teams to adapt to your business model, client needs, and changing service lines is easily adjusted, giving them unrivalled flexibility.

Full-time workers make excessive use of their time in transactional activities. Through outsourcing, routine work is handled, allowing CPAs to concentrate on advisory services, financial planning, and customer relationship development.

These more value-added services enable companies to increase revenues, attract high-end customers, and rebrand themselves as strategic partners, not just as number-crunchers.

Whether especially during tax season surges or when a company is onboarding new clients, outsourced accounting enables companies to scale services up or down easily. Such agility is essential for companies expanding into new markets or those serving multiple sectors.

Because they are outsourced, these staff can fast-track your business model, meet customer needs, and develop service lines - this is unrivaled flexibility.

People should prioritize the safety of their data, especially in accounting firms, as the threat level of cybersecurity is increasing. Collaborating with experienced providers of cloud accounting services in Canada is another way to move with reliable systems, encrypted filing, and frequent data backup.

Such accounting services include more secure access controls and rules as required by Canadian laws on data privacy, which protect sensitive data related to the firm's financial matters and those of its customers.

In the future, digital transformation is reshaping the accounting profession in Canada. New trends are emerging rapidly, including automation, AI-based analytics, and cloud-native solutions. Outsourced accounting companies serve as a new strategic partner in such an environment, as they act as an ally to CPA firms that wish to maintain a lean and competitive organization.

Payroll management, tax return preparation, accounts payable, and accounts receivable are some of the tasks that are being increasingly outsourced to trusted individuals who provide the necessary tools, platforms, and knowledge of regulations.

As clients evolve their requirements to go paperless and demand quick, mobile-enabled services, firms are compelled to move beyond bookkeeping. The utilization of cloud technology enables real-time collaboration, makes reporting smarter, and provides a better overall client experience.

To meet such requirements, CPA outsourcing services are now imperative. The companies enable firms to do more, without straining internal resources. By utilizing experienced resources and sophisticated cloud accounting in Canada, accounting practices are becoming financial centers of the future.

Regardless of whether you are a growing practice in Toronto or a boutique firm in Vancouver, the Future of Accounting is not only digital but also outsourced, cloud-powered, and scalable.

This may be a strategic decision in selecting your partner for matters concerning outsourced accounting in Canada, which can significantly impact the efficiency of your firm, client satisfaction, and its growth prospects. In 2025, more CPA firms and accounting professionals shall approach outsourcing, and it is only vital to consider service providers with scrutiny.

Use services provided by outsourced accounting companies capable of learning the ins and outs of Canadian industries--be it retail, tech, real estate, or healthcare. Practice makes things reliable and sector-specific. This enhances service provision.

The outsourcing firm shall be well-versed in Canada's current taxation policy, as well as the current GST/HST rules and CRA audit measures. A compliance-oriented provider helps avoid costly mistakes and ensures peace of mind.

Search Canada-based firms that provide powerful cloud accounting services. Familiarity with such platforms as QuickBooks, Xero, or NetSuite enables parts of it to be linked in real-time and even automated.

Regardless of whether you are a single CPA or a multi-location accounting practice, your partner must have flexible engines well-suited to scaling with your requirements. Whether it is monthly bookkeeping or year-end, scalability is the word in 2025.

Avoid extra charges and unclear service conditions. Select a partner that has simple pricing, transparent SLAs, and support.

The best partners are those that maximize the interests of Canadian companies, as they are familiar with the local tax cycles, economic trends, and regulatory environments. This makes it accurate in context and effective in time.

At Aone Outsourcing, we check all these boxes. The CPA outsourcing solutions we offer are developed by Canadian-based firms that want to achieve stable and scalable accounting services on a technology-led platform. You have 10 clients, or 1,000; we make your operations smooth and efficient.

A competitive, fast-paced marketplace implies that outsourcing accounting in Canada (2025) is no longer an option, but a necessity. You can cut expenses, speed up turnaround times, or even increase the number of services you currently provide. Still, the advantages of outsourced accounting would be undeniable.

CPA firms and accountants can remain agile, compliant, and focus on strategic relationship building through collaboration with the right service provider. Outsourcing means that your firm can scale and adapt with confidence, whether it is year-round support or cloud accounting services in Canada. It is time to go smarter with technologically enabled, future-built accounting solutions.

Searching for a dependable Canadian outsource partner?

Aone Outsourcing provides dependable, economical, and cloud-based CPA outsourcing services to transform the performance of your organization.

FAQs

In Canada, outsourced accounting services can be utilized to reduce operational expenses, achieve a high degree of accuracy, and access professional financial expertise without the need to hire employees. It also enables companies to focus on strategic growth while complying with CRA regulations.

Business firms outsource to save expenses, maximise productivity, and acquire expertise. In 2025, numerous Canadian companies are expected to rely on CPA outsourcing to expand their operations and keep pace with the rapidly evolving accounting technology.

Will it save me time and money? Yes, it saves you time, provides better accuracy in bookkeeping, and makes your cash flow more transparent. It is the best outsourced bookkeeping advantages for small and medium-sized companies and accounting firms in Canada.

In accounting, outsourcing refers to contracting out functions such as payroll, tax filing, or bookkeeping to third-party providers. Outsourcing accounting companies provide elastic, cloud-based services. Accounts that service your company's requirements.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .