GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Do you spend too much time on payroll activities and worry about payroll compliance? In-house payroll management proves to be a hectic process for many Canadian businesses. The procedure is not only complicated but also time-consuming; there is a need to calculate salaries and deductions, as well as stay on top of CRA obligations, Canada Pension Plan (CPP), Employment Insurance (EI), and provincial taxes.

This is the reason why more business establishments are opting to use outsourcing payroll companies. Third-party payroll service providers offer expertise in this area, utilising automation and secure platforms that guarantee precision and conformity while simultaneously decreasing internal administrative overheads. Ensuring the payment of salaries, taxes, and handling year-end tasks can be an outsourcing process that simplifies the entire process, providing a sense of relief and peace of mind.

For start-ups, SMEs, franchises, and even payroll services accounting firms, outsourcing will provide a flexible, affordable, and scalable operation that effectively addresses the Canadian market. It enables the owner, business, and financial departments to transfer their focus to more strategic decision-making, ultimately facilitating growth, efficiency, and a sense of empowerment.

Third-party payroll services are a commercial arrangement in which a company contracts with a third party to handle its payroll-related activities. These outsourcing payroll companies are professional payroll processing firms that possess the knowledge, systems, and resources necessary to process payroll efficiently, securely, and in compliance with all applicable Canadian laws and regulations.

These services are particularly beneficial to small and mid-sized businesses, as well as payroll services accounting firms, that require economical, steady-handed relief to assist them regularly without the need for employing a payroll professional on a full-time basis.

Daily tasks that third-party providers perform are:

Payslip Generation: Ensuring the correct presentation and preparation of payrolls for employees.

Tax Deductions & Remittance: Figuring and filing the tax on income, CPP, and EI contributions to CRA.

Record of Employment (ROE) Filing: The Preparation and filing of ROEs upon layoffs, resignations or terminations.

Year-End Tax Filing: The preparation of T4 and T4A slips and the preparation of year-end statements to both employees and government officials.

The need to outsource payroll services ensures that such complex activities are executed with accuracy and timeliness, minimising compliance risks and administrative frustrations. These services can also be integrated with payroll accounting software to provide real-time information, as well as efficient bookkeeping, making them a good and viable choice for a growing business in Canada.

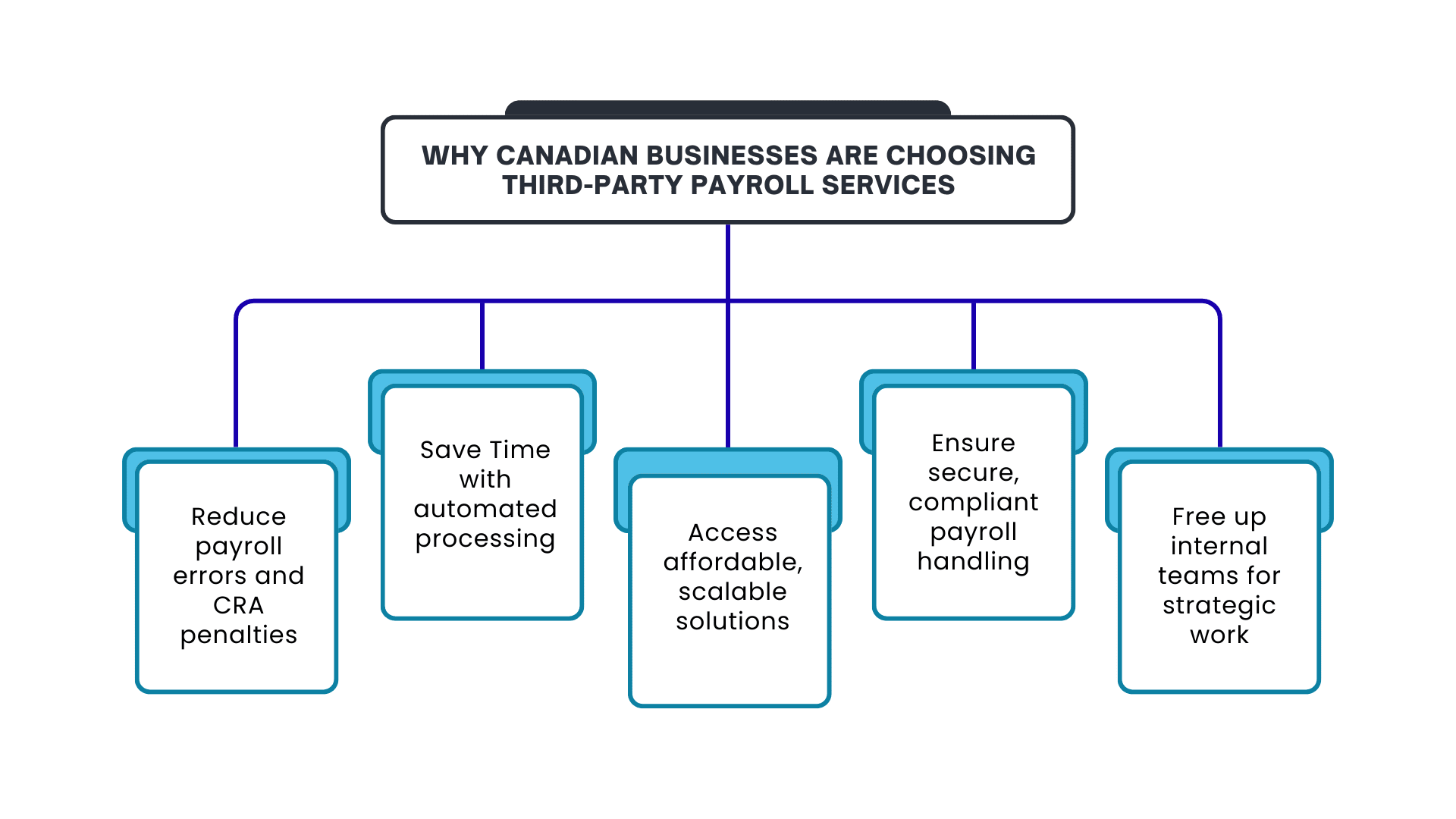

What initially began as a trend is now a business model, with companies using payroll outsourcing to outsource their operations, simplify activities, and reduce errors, thereby concentrating on expanding their businesses. The key benefits of the collaboration with the professional payroll services providers in Canada are outlined as follows:

Payroll is governed by strict rules and regulations in Canada, both at the federal and provincial levels, concerning the Canada Revenue Agency (CRA), the relevant considerations of Canada Pension Plan (CPP) contributions, Employment Insurance (EI) repayments, and other provisions of income tax. These rules are lengthy and themselves subscribe to changes more often than not.

Payroll service providers excel in adhering to these rules and managing all payrolls, including tax payments, T4 and ROE filings, and other related tasks, correctly and on schedule. This reduces the possibility of fines and audits; it even eliminates legal problems. Employers can be assured that payroll is calculated by up-to-date statutory requirements, thereby reducing the hassle associated with year-end reporting and CRA audits.

There is more to employee salaries than running an in-house payroll department. Companies must purchase payroll software, attend regular training sessions, seek technological assistance, and adapt to changes in legal requirements. These costs can be very high, especially for many small and medium-sized enterprises (SMEs).

Affordable payroll services can be made through cost-effective services. Businesses can save on the cost of installing costly infrastructure and also benefit from fixed or pay-as-you-use pricing through outsourcing. Most payroll outsourcing companies offer flexible packages tailored to the company's size and payment frequency. This makes them very cost-effective for expanding businesses, which need to balance budgets without compromising accuracy and compliance.

The payroll process is time-consuming, detail-oriented, and involves duplicate data entry. Their mistakes not only slow down the activity within the company, but they can also generate employee dissatisfaction.

Outsourcing payroll services saves a company a significant amount of time and resources. Routine calculations, the generation of pay slips, and the remittance of taxes are all handled by automation, whereas compliance and reporting are left to dedicated experts. This allows personnel on the inside, especially those in the HR and finance offices, to focus on more strategic tasks, such as talent management, budgetary matters, and business development, making them feel more productive and efficient.

Canadian payroll service providers have refined their use of advanced payroll platforms to deliver secure, efficient, and seamless services. Such systems typically contain:

Access to real-time payroll data using cloud-based Citrix access to payroll. The benefit of this approach is the real-time access to payroll data.

Combination with accounting software such as QuickBooks, Xero or Sage

Encryption of data to guarantee protection against unauthorised access to information on employees and financial data

In the event of system failure, an automated backup must be in place to prevent data loss.

Outsourcing enables businesses to access highly advanced technology without incurring the cost and spending the time on its maintenance. Additionally, the security features have been improved to guarantee the protection of sensitive payroll data against data breaches and cyberattacks.

Whether a start-up is entering new markets, recruiting new employees, or managing seasonal staff, outsourcing payroll is guaranteed with unparalleled scalability. Providers can rapidly adjust services according to workforce quantity, compensation patterns, and geographic location; therefore, companies can continue to be nimble without having to wait before operations begin.

The flexibility, in particular, proves very useful to Canadian businesses with seasonal employment patterns, but not those in agriculture, hospitality, or retail. By allowing third-party providers to manage payroll activities rather than internal teams during peak seasons, these providers ensure a smooth payroll process, whether the volume is high or low, and regardless of the complexity of the activities involved.

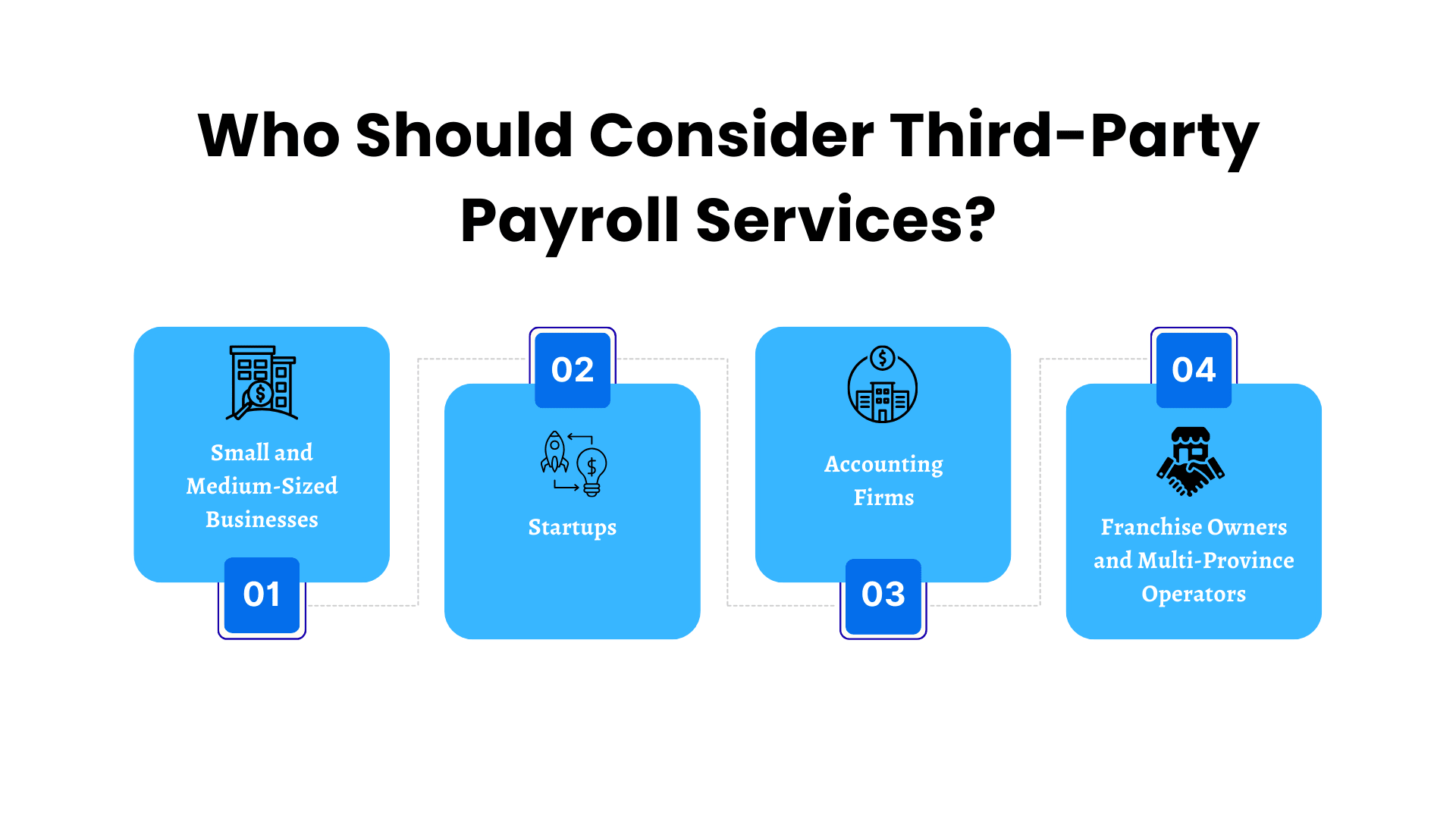

Even though payroll outsourcing proves helpful to any business entity, some organisations may enjoy it especially by contracting a professional payroll services provider. Insofar as the steps of cost-related problems, compliance, and operational capacities are related, the following types of businesses could be considered the most adequate candidates to resort to the assistance of third-party entities in processing payroll:

Listed among some of the third-party payroll services providers in Canada are ADP, Ceridian and Payworks. These vendors offer a range of services, including basic payroll management to comprehensive HR and benefits management, catering to businesses of all sizes.

On average, startups are new businesses with limited resources and intense interest in scaling up. Payroll infrastructure is often not a priority, yet it does require compliance. Outsourcing is an effective way to ensure a startup complies with CRA regulations, as low costs are maintained through outsourcing; payroll accuracy begins at the time of setup.

To payroll services accounting firms, outsourcing can be a value-added development of their services. At the same time, by collaborating with white-label payroll service providers, companies can offer clients an end-to-end payroll experience without having to develop an internal payroll department. It will enable them to focus on their primary accounting and advisory services without overextending their portfolio.

Firms with businesses in more than one province should adhere to different labour laws, tax rates, and regulatory conditions. Because payroll outsourcing vendors have an in-depth understanding of local differences, clients can always have peace of mind knowing that their workers from all areas will have a correctly processed payroll. This will be particularly beneficial to national franchises and companies with distributed workforces.

By outsourcing regular and tedious payroll duties to third-party payroll service providers, worthy businesses save time and prevent expensive errors. These are the basic services which are usually covered:

Salary Calculation: Proper calculation of the wages, bonuses, overtime and deductions of the employees according to their contract and timekeeping.

Tax and CRA Insights Remittance: Income taxes, CPP, EI and other withholdings are automatically calculated. Reimbursement is made at the appropriate time to the Canada Revenue Agency, ensuring compliance with the relevant regulations.

Direct Deposit Request: Smooth payment of their employees in terms of secure automated bank transfers.

Year-End Tax Filing (T4, T4A): T4/T4A slips and summaries must be prepared and issued to employees and the CRA.

Production of Record of Employment (ROE): Submitting the ROE to employees when they are on leave, dismissed, or quitting their jobs is required in EI claims.

Employee Benefits Administration: Handling the collection of contributions, retirement plans, deductions, and reports about the group benefits/pension/retirement.

Outsourcing these activities reduces the number of errors and enables businesses to comply with Canadian payroll requirements.

The variety of providers available on the market is substantial; it is essential to select an appropriate partner to ensure convenient and risk-free payroll operations. Comparing payroll service providers in Canada, the following are some of the points that should be considered:

The provider is expected to be knowledgeable of CRA rules and regulations, provincial rules and regulations, labour laws, and other relevant regulations. Experience is key in navigating complex compliance matters.

The characteristics of a payroll system that an updated provider should offer include automated payroll, real-time reporting, and the ability to integrate with widely used accounting systems.

Examine transparent and easily predictable pricing models without other hidden costs. The providers shall offer tier schemes based on the size of the companies or the frequency of the wage payments.

The information is sensitive in the sense that it involves payroll. Therefore, ensure that the provider utilises advanced information protection, such as encryption, secure servers, and frequent backups.

A clear communication network, the availability of customised reports, and a responsive support team can make the process much better. Seek out providers who provide real-time dashboards, tax summaries and documentation that can be easily accessed.

Selecting the right provider enables business owners to enjoy a smooth, stable, and cost-efficient payroll operation, allowing them to focus on strategy and expansion.

The payroll is a core business process that can be time-consuming, costly, and hazardous to manage alone in Canada, where the regulatory climate is quite stringent. With the help of reliable payroll service providers that have the experience, the business will have a secure feeling that their payroll is precise, compliant and administered by specialists.

The advantages of outsourcing payroll services are evident, as they leave the business in a better position, such as avoiding compliance risks and improving security, among others, by saving time and money. Outsourcing is an intelligent solution, whether you are an expanding business, a startup, a multi-location operator, or one of the numerous payroll services and accounting firms looking to augment your services.

Aone Outsourcing provides reliable, technologically based, and affordable payroll services that align with your business interests in Canada.

Contact us now and eliminate the stress of your payroll compliance.

They are third-party entities that perform payroll duties, such as calculating salaries, deducting taxes, and ensuring compliance. The primary motivation for businesses to outsource is to save time, minimise errors, and ensure compliance with CRA.

The Canada Revenue Agency, commonly referred to as CRA, governs payroll deductions and payroll taxes. Employers are required to remit income tax, CPP, and EI to the CRA.

Yes, there are reputable providers with secure systems that are encrypted and whose privacy policies are adhered to. They guarantee data protection, adherence, and accuracy throughout the entire payroll process.

It is a software developed by third-party vendors to undertake precise business functions. Third-party software is commonly used for payroll, accounting, and HR tools.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .