GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

It seems easy to handle in-house payroll in the short run. You have a small company, the procedure is simple, and the programs do what they are supposed to do most of the time. However, the business expands. More workers, more states, more deadlines. All of a sudden, what used to take an hour a day goes up to consume half of your week.

The numbers get more complex. The CRA rules seem to change every quarter. And the stakes? Much higher.

A late payment, a missed deduction, an error on a T4—it’s not just an internal hiccup anymore. It’s a frustrated employee. A fine from the CRA. A credibility hit you didn’t see coming.

That’s the turning point for many Canadian businesses. Payroll stops being “just a task” and becomes a risk. A distraction. A source of ongoing pressure.

That’s when outsourcing stops being a luxury and starts making perfect sense.

In this blog, we’ll explore how to recognise when your business has outgrown in-house payroll, what risks you might already be facing without realising it, and why so many companies across Canada are turning to Aone Outsourcing Solutions for reliable, secure, and fully compliant payroll services.

If payroll is causing more stress than it should, you’re not behind—you’re just ready for better.

Payroll outsourcing means hiring an external firm, like a specialised payroll agency to manage some or all aspects of your payroll process. That includes calculating wages, tax deductions (EI, CPP, income tax), direct deposits, CRA remittances, T4/ROE preparation, and compliance with federal and provincial rules.

Outsourcing payroll services has become popular in Canada in recent years, as businesses face mounting pressure to:

Meet CRA remittance deadlines

Adapt to evolving labour laws

Pay employees on time and accurately

Avoid costly penalties due to human error

With the support of a provider like Aone Outsourcing Solutions, you can fully offload payroll stress and gain peace of mind.

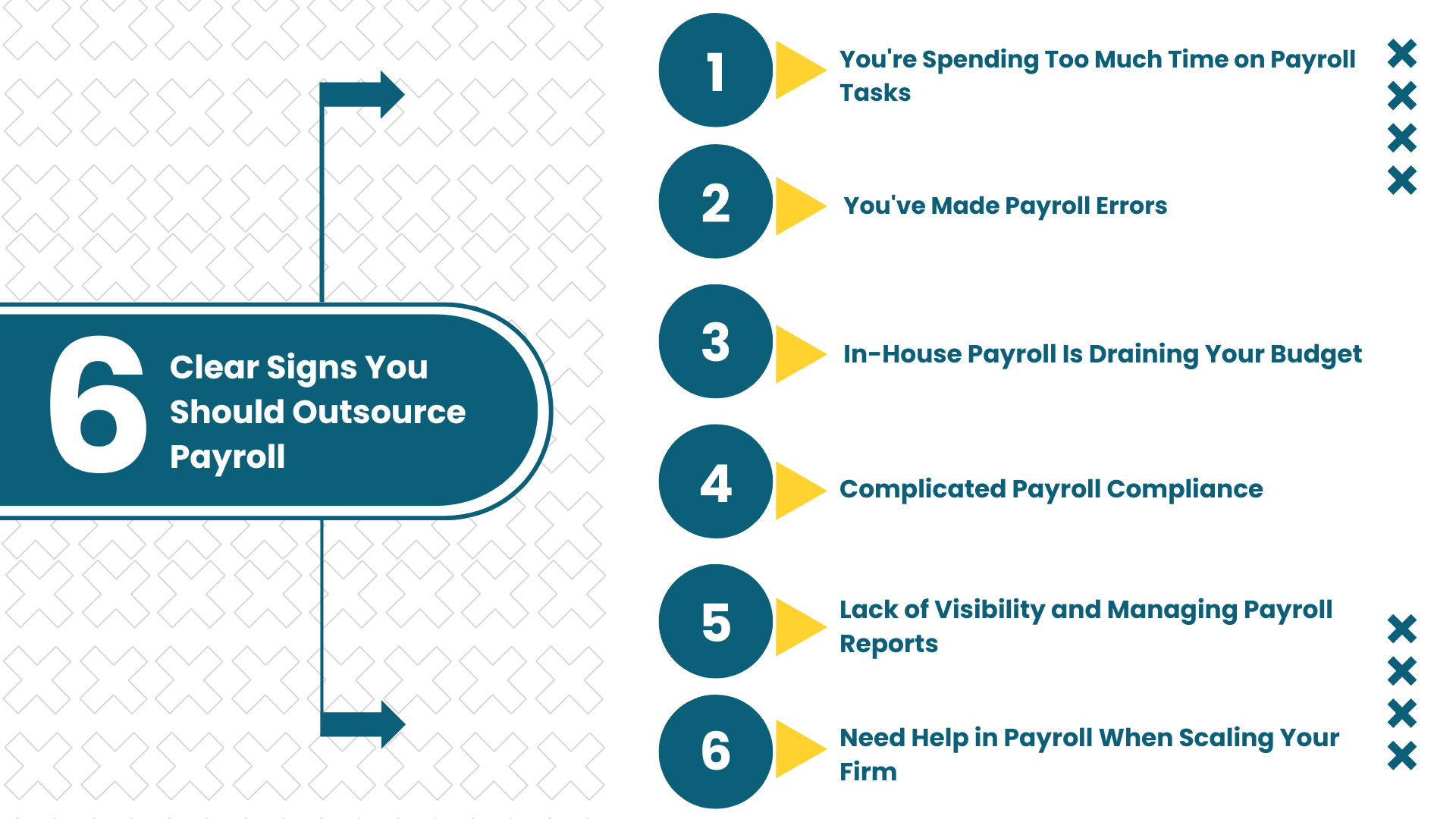

Not every business starts with payroll outsourcing—but at some point, managing it in-house becomes more of a liability than a benefit. If you're noticing any of the following issues, it’s time to consider working with a professional payroll agency like Aone Outsourcing Solutions.

These six signs are common indicators that your internal payroll process is slowing down your business, increasing compliance risks, or draining your resources unnecessarily.

If your HR or admin team is constantly bogged down with timesheets, deductions, payslip generation, or chasing CRA deadlines, your payroll process has become inefficient.

Payroll involves more than just issuing salaries — it includes:

Tracking work hours, overtime, bonuses

Calculating income tax, CPP, and EI deductions

Preparing and submitting remittances to the CRA

Handling payroll queries from staff

Managing year-end slips (T4, T4A, ROEs)

Even if you’re using payroll software, the time and effort needed to maintain accuracy and compliance can be significant, especially for growing businesses.

Penalties for late or missed tax remittances

Employee frustration and mistrust

CRA audits and scrutiny

Time-consuming corrections and reconciliations

Manual errors, like misclassifying an employee as a contractor or using outdated tax tables, can be difficult to spot until it’s too late.

Payroll may not seem expensive—until you start adding it all up.

Here’s what many Canadian businesses forget to factor into in-house payroll:

Cost of payroll software licenses and upgrades

Staff time spent on processing, training, and compliance

Fines for occasional compliance errors

IT security systems to protect employee data

Year-end tax preparation and T4 slip generation

On the other hand, outsourcing payroll services provides access to all of these (and more) at a fixed monthly type of fee, with no hidden charges or extra burden on your team.

Payroll compliance in Canada is different for all regionsl. Rules vary widely between provinces, which means what works in Ontario might lead to errors in British Columbia, Quebec, or Alberta.

Differences in statutory holiday rules, overtime calculations, minimum wage rates, paid leave entitlements, and even remittance deadlines can trip up businesses operating across multiple regions. If you’re managing payroll in-house, staying on top of these ever-changing provincial requirements can feel overwhelming and mistakes can be costly.

Managing multi-province payroll in-house becomes incredibly difficult as you scale.

Do you struggle to answer questions like:

How much did we spend on payroll this quarter?

How many hours of overtime were paid last month?

What were the total employer contributions to CPP and EI?

If you don’t have easy access to detailed payroll insights, it’s hard to manage labour costs, budget accurately, or stay audit-ready.

Many businesses still use basic tools like spreadsheets or outdated software that lack the power of automation and real-time reporting.

The bigger your team the more the requirements that are required by your payroll system. When the company hires more employees, the additional data on the payroll needs to be processed, more deductions need to be calculated, and more possibilities of making errors emerge.

The symptoms of scalability problems are:

Delays in adding new employees to payroll

Struggles managing different pay frequencies or structures

Confusion around bonuses, commissions, or contractor payments

Missed payrolls or frequent reruns due to errors

Bottlenecks during peak periods (year-end, CRA deadlines)

When Canadian businesses approve payroll outsourcing, they do not want of a person who will merely run numbers. They want a reliable ally that can oversee precision, and conformance.

These are the reasons why you can select us instead of using outsourcing of payrolls:

We are not just a off the shelf provider. Aone is focused on providing payroll services in Canada, and it knows inside out the federal as well as provincial regulations, including CRA remittances and the province-specific payroll regulations in Quebec. We monitor all the changes in taxes, statutory holiday provisions, and deadlines in regulation so you do not have to.

Real Advantage:

No guesswork. No outdated deductions. Just error-free payroll aligned with the latest legislation, every time.

At Aone, our payroll services come with clear, fixed pricing—no hidden fees or per-employee surprises. You get unlimited pay runs, full CRA filings, ROEs, T4s, and expert support all bundled into one predictable monthly cost. It’s simple, scalable, and built for growing Canadian businesses.

At Aone, our payroll services come with clear, fixed pricing—no hidden fees or per-employee surprises. You get unlimited pay runs, full CRA filings, ROEs, T4s, and expert support all bundled into one predictable monthly cost. It’s simple, scalable, and built for growing Canadian businesses.

Our cloud-based payroll system gives you real-time access to everything—pay history, deductions, employee records, and CRA submissions—all in one secure place. It’s fast, reliable, and always audit-ready, so you stay in control without the stress.

It’s like having a payroll department in your pocket—secure, fast, and audit-ready 24/7.

From late remittance penalties to employee misclassification, payroll errors cost Canadian businesses thousands each year. With Aone, compliance is never an afterthought—it’s baked into our process.

We take care of:

Accurate CPP, EI, and tax deductions

Timely CRA remittances

Year-end slips (T4, T4A, ROEs)

Multi-province payroll complexity

When payroll gets complex, you don’t want to talk to a chatbot. You want someone who understands your file. At Aone, every client gets access to a dedicated payroll expert who knows your setup inside out. We don’t just process payroll, we solve problems before they happen.

Are you an accountant managing payroll for multiple clients? Or a business with multiple entities across provinces? Aone is built to support you with scalable solutions that centralise processing, reduce admin, and improve turnaround time without sacrificing accuracy.

Payroll isn’t just about paying people—it’s about protecting your business from penalties, building employee trust, and staying compliant with complex tax laws that never stop changing.

If you’re constantly double-checking numbers, worrying about CRA deadlines, or losing sleep over payroll errors, your current process isn’t serving you anymore.

Outsourcing payroll doesn’t mean losing control—it means gaining back your time, reducing risk, and getting expert support that works in the background while you focus on what matters most.

At Aone Outsourcing Solutions, we’ve helped businesses across Canada move from manual payroll chaos to a clean, automated, and worry-free payroll system. Our services are designed to grow with you, fit your budget, and eliminate errors before they happen.

Payroll outsourcing is when a third-party provider handles your full payroll process—from calculating wages, deductions (CPP, EI, income tax), and direct deposits, to submitting CRA remittances and filing year-end slips like T4S and ROEs. You feed in employee data, and the provider runs everything accurately and on time.

According to QuickBooks, outsourcing payroll can reduce operating costs by around 18 %, eliminate manual errors, and help maintain compliance with evolving tax and employment laws It also provides reliable reporting, data security, and frees up your teams to focus on strategic work.

It has one or two possible pitfalls: providers can impose some hidden costs (e.g. off the cycle payment, termination costs), it has a reduced ability to schedule around the providers, providers feel like it loses internal control.

Key evaluation criteria include:

Experience with Canadian payroll and regional compliance

Transparent, fixed-fee pricing

Secure, cloud-based platforms

Reliable support (not call-centre scripts)

Smooth accounting or HR integrations

Yes, leading providers use enterprise-level encryption, access controls, data backups, and compliance with Canada’s PIPEDA standards. This ensures payroll info is far safer than with manual or spreadsheet-based systems.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .