GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Being an entrepreneur in Canada is a challenging task. Along with the costs and customer demands, and the goal of remaining relevant in the digital-first economy, most business owners do not have the time to review whether their bookkeeping is performed correctly. This is why many people prefer bookkeepers to work on their financial documents - as long as all of it is proper, up to date, and risk-free.

The thing is, not every bookkeeper is made of the same cloth. A casual or outdated method of managing your books may silently put your business at risk. The results of CRA penalties on their cash flow can be disastrous. These risks can be even more frustrating to Millennials and Gen Z entrepreneurs who prize transparency, speed and digital convenience.

That is, how on earth can you tell whether your bookkeeper is working in your business interests--or against them? This blog will highlight the major red flags to be vigilant of, the implications of leaving them unchecked, and the solutions that can be adopted. And best of all, we will demonstrate how bookkeeping outsourcing with Aone Outsourcing brings accuracy, efficiency, and the peace of mind that Canadian businesses deserve.

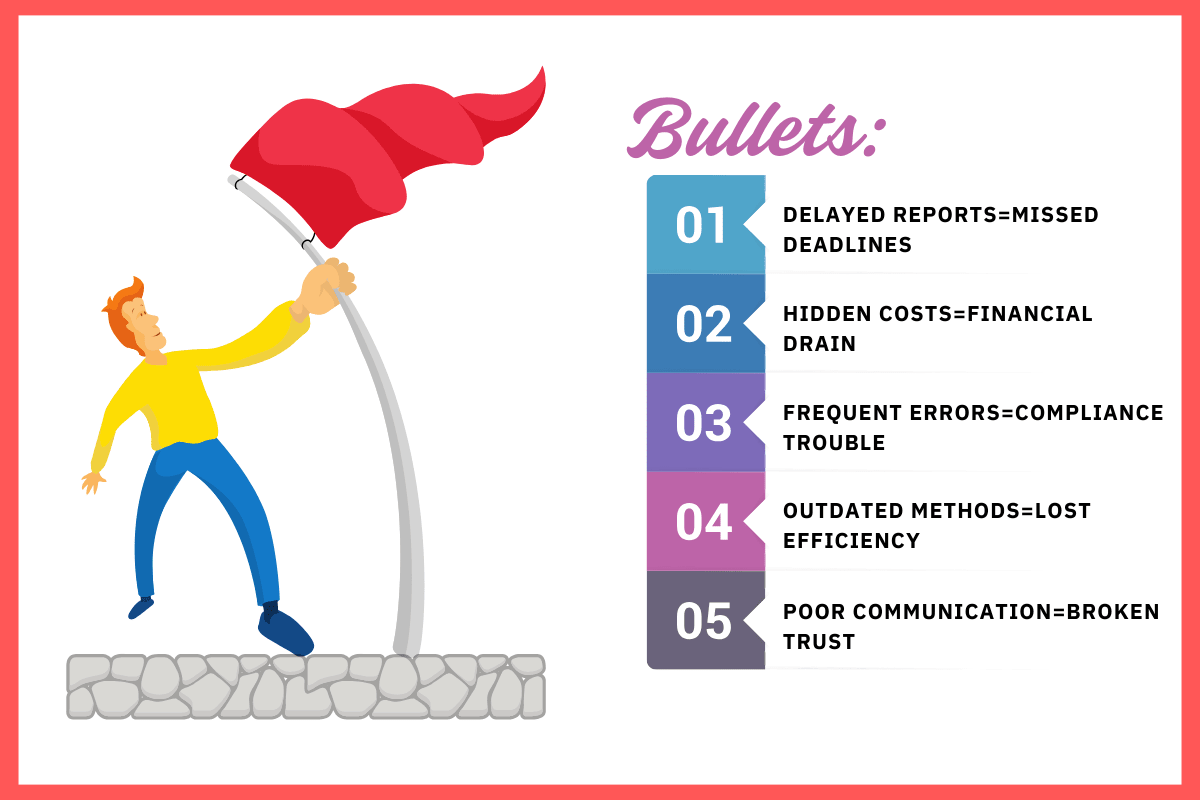

By identifying a red flag before it is too late, you can save your business from larger financial losses in the future. Not only do each of the warning signs pose potential dangers in the event of negligence, but they also have evident solutions. In the section below, we take a closer look at the most frequent red alerts that business owners in Canada need to consider, the potential impacts of letting them go unresolved, and the feasible solutions that can be employed.

The Red Flag:

You should be able to obtain reports and other information readily from your bookkeeper, and they should not be evasive about providing details. Transparency implies that you must have access to financial information when needed, without confusion or delay.

The Consequence:

A visual cocoon leads to a blind spot. You may be unknowingly omitting indicators of fraud or misreporting, or poor expenditure culture. The answer, however, is not that I do not know when the CRA shows up. Investors and lenders become pessimistic when you are not able to come up with clean, on-time financials.

The Resolution:

Transparent and continuous reporting, along with access to your financial data, should be available to you at your convenience. Your financials are readily available in real-time, and cloud bookkeeping solutions like QuickBooks Online or Xero make it easy to access. When your bookkeeper is opposed to such transparency, it means they are not accurately maintaining your books.

The Red Flag:

Mistakes happen to all people, but monthly errors, incorrect reconciliation, or a lack of invoices in your financials is careless.

The Consequence:

Mistakes can trigger a domino effect. An incorrect entry would result in inaccurate tax filings, CRA examinations or even damage to the reputation when the stakeholders come across flawed reports. Most horribly, you might make a business decision by using bad numbers.

The Resolution:

Precision is indisputable. In modern bookkeeping, automation is utilized to minimize human errors, and additional checks and reviews are implemented to verify accuracy. When your bookkeeper is basing their operations on obsolete spreadsheets and manual input, that is something to reconsider.

The Red Flag:

Does your bookkeeper have to rush at the last minute to file taxes? Is remittance late, such as payments due on payroll, or GST/HST returns? These are worse than habits; they are expensive lapses.

The Consequence:

The CRA will not entertain late filing—failure to meet deadlines results in penalties, interest, and even potential auditing. When there is a delay in payroll, employees also lose trust, which can lead to dissatisfaction in the workplace.

The Resolution:

Bookkeeping is a proactive planning. A good bookkeeper will maintain a financial calendar, set reminders, and ensure that all submissions are made on time. When deadlines are a constant problem, then outsourcing can provide you with a team of professionals that will never miss a deadline.

The Red Flag:

That your bookkeeper is stuck in the stone age, using systems such as Excel sheets and paper books, and omitting automation, is a serious red flag.

The Consequence:

Old habits are inefficient and more prone to mistakes. They will continue to put your business areas at a disadvantage compared to more tech-savvy industries that are adopting cloud accounting, AI, and finance-based automation. Without modernization, you experience inefficiency and a lack of scale.

The Resolution:

A company poised to be ready for the future must be bookkeeping-ready. Real-time dashboards, cloud-based software, and automation tools are no longer luxuries; they are now the standard. When your bookkeeper refuses to change, then your growth is getting impeded.

The Red Flag:

Has your bookkeeper ever ghosted you? Do they avoid or evade your questions or reply evasively, or are they only calling when there is a problem? Bad communication.

The Consequence:

In the absence of proper communication, you stay in the dark when it comes to your finances. Lost opportunities and unsolved problems are by-products of misunderstanding. Slow or clear communication is off the table for entrepreneurs who are younger and need to be updated instantly.

The Resolution:

You should have responsive and proactive communication. A good bookkeeper will communicate finances in an easy-to-understand language, offer periodic updates, and keep you informed about the current state of your business at all times.

The Red Flag:

Bookkeeping is not only about numbers, but rather, compliance. When the bookkeeper is unaware of current Canadian tax regulations, GST/HST regulations, and provincial payroll regulations, your business is at risk.

The Consequence:

An inaccurate filing may activate the CRA penalties, payroll mismanagement, or an end-to-end audit. The final addition your business requires is a compliance failure that it could have prevented.

The Resolution:

Your bookkeeper must also be trained and up-to-date on CRA rules, provincial laws, and industry terms. They should not lead you through compliance with confidence, only to endanger you.

So, what is the answer when you encounter these red flags? Outsourcing your bookkeeping.

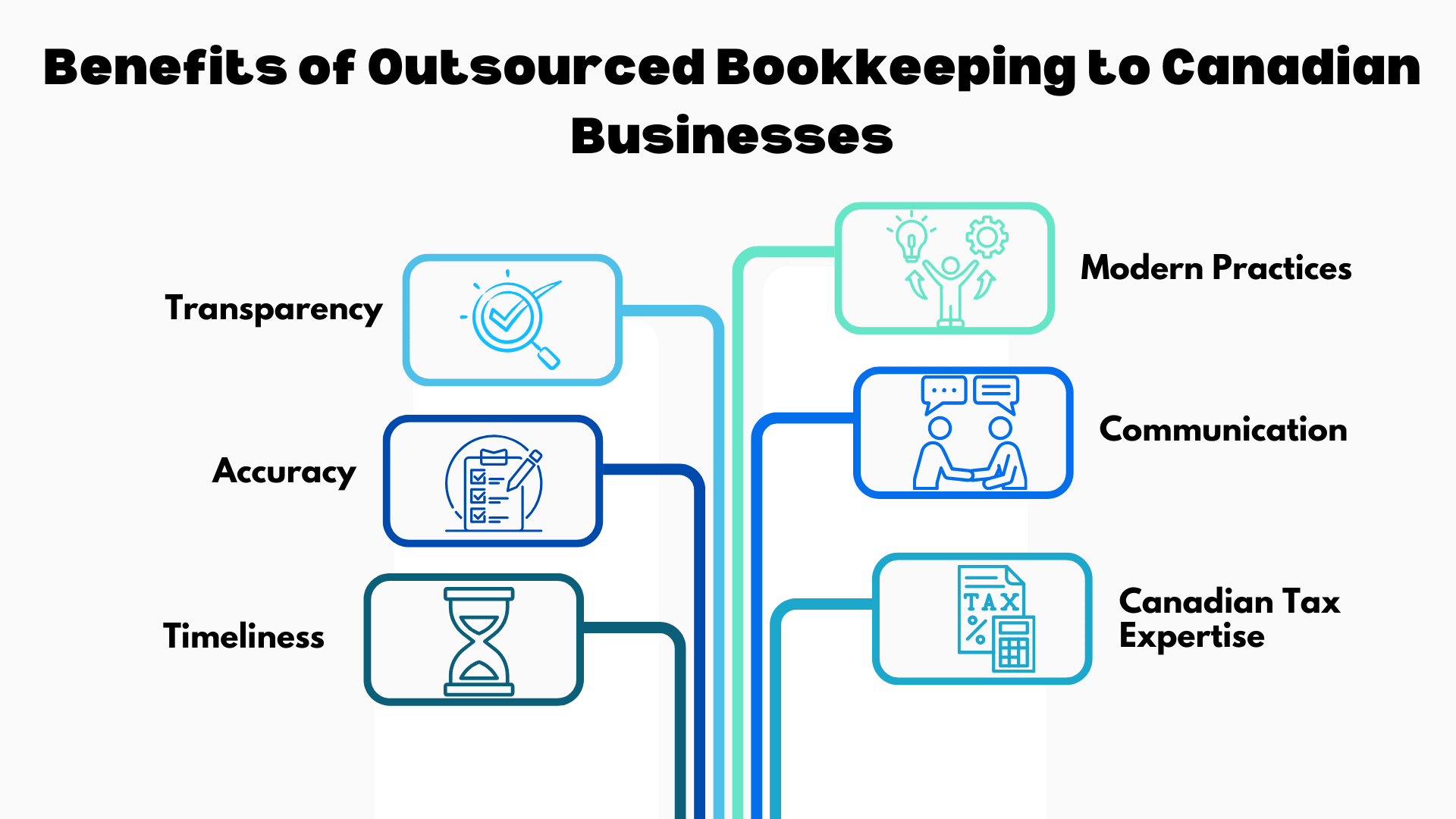

Outsourced Bookkeeping is no longer a cost-cutting tool, but a savvy, new-age business practice. The following is how Aone Outsourcing addresses all red flags that affect Canadian businesses:

Transparency: You are never left wondering what is happening. We deliver real-time dashboards and open dashboards that are easily understood and readable.

Accuracy: Our professionals utilize automated tools and multi-level verification to minimize error levels.

Timeliness: An exceptional crew, and you will never fall short in CRA deadlines or payroll schedule again.

Modern Practices: We use the speed and dynamism of cloud accounting, AI integrations, and automation.

Communication: Our support team practices proactive, transparent and responsive global time zone communication.

Canadian Tax Expertise: We stay up-to-date with CRA requirements, GST/HST, and provincial payroll regulations —so your compliance is never in jeopardy.

Outsourcing also means that Gen Z and Millennial founders, who value flexibility, can easily access their financial information, regardless of their location, whether they are working remotely, managing a startup, or a growing enterprise. You will spend less time and effort trying to figure out how you messed up bookkeeping and concentrate on business development.

Bookkeeping red flags are not mere inconveniences but can be indicators that your business may be in danger. Negligence in ignoring these warning signs could cost you money, time, and credibility, including CRA penalties and cash flow breakdowns.

The positive part? You do not need to handle it by yourself. Outsourced bookkeeping services with Aone Outsourcing provide Canadian businesses with accuracy, transparency, compliance, and modern financial management without the added pressure of in-house financial management.

It is not after a mistake or even a CRA letter that surprises you that you should act. Today, partnering with Aone Outsourcing makes bookkeeping transparent, accurate, and future-ready.

In business, a red flag is an indication that something is wrong, such as missed deadlines, frequent cases of financial misjudgments, or a lack of transparency. Such concerns may pose a threat to your company in terms of compliance, cash flow and reputation.

A bookkeeper will be reliable when they are upfront and honest in reporting, clearly explain the information they possess, exercise contemporary bookkeeping applications, and have a grasp of Canadian tax legislation and CRA adherence.

Adequate separation of costs between personal and business use is one of the most frequently made errors. This clouds the books and makes it difficult at tax time or a CRA audit.

The key responsibility of a bookkeeper is to maintain accurate financial records, including transactions, payroll, taxes, and compliance with Canadian financial laws.

The primary golden rule of bookkeeping is: Debit the receiver, Credit the giver. It ensures that all transactions are accurately recorded in the accounting system, utilizing the double-entry approach to accounting.

The most significant challenge that bookkeepers face in the current context is staying up-to-date with the changing tax rules in society, as well as the new technology, and accurately and error-free managing their financial transactions.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .