GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

As June approaches, many Canadians are once again looking forward to a little extra financial relief from the GST/HST credit. In a time when food prices, rent, and energy bills are stretching household budgets thin, even modest tax credits can help families breathe easier.

If you're wondering when the CRA will issue the GST/HST credit in June 2025, how much you might receive, or whether you qualify at all, you're not alone. Thousands are searching for clarity as the CRA benefit payout date nears.

This comprehensive guide dives into everything you need to know, including eligibility requirements, the updated CRA June payout schedule, estimated credit amounts, how to ensure you receive your payment, and what to do if yours hasn’t arrived. We also explain how filing your 2024 tax return is critical in securing this quarterly benefit, and why missing that step could cost you.

The Goods and Services Tax or the Harmonised Sales Tax (GST/HST) credit is a vital financial aid tool for millions of low- and moderate-income Canadians. Paid quarterly and tax-free, this federal benefit is designed to offset the GST/HST reconciliation that individuals and families pay on essential goods and services.

While the amounts may seem modest at first glance, the value of this benefit becomes increasingly important during economic uncertainty, inflationary periods, or personal financial hardship. The credit is especially helpful for seniors, students, single parents, and newcomers trying to make ends meet.

And because it’s a non-taxable payment, recipients can use it however they need, from groceries and transportation to utility bills and medication. As household budgets tighten across the country in 2025, knowing how and when to access this support is not just useful, it’s essential.

The Canada Revenue Agency (CRA) has officially confirmed that the next GST/HST credit will be issued on June 5, 2025. This payout marks the first payment of the new benefit cycle (which runs from July 2025 to June 2026), but it is based entirely on your 2024 income tax return.

In other words, what you receive in June reflects the income and family details you reported for the previous calendar year. The CRA issues these credits four times a year, in January, April, July (advanced in June), and October. If you're enrolled in direct deposit through your CRA My Account, your funds will typically arrive on time or within one business day.

If you’re receiving a paper cheque, allow a few extra days for delivery. For Canadians relying on this benefit to cover essential expenses, missing the CRA's deadlines or failing to file can mean waiting months for what should have been your rightful credit.

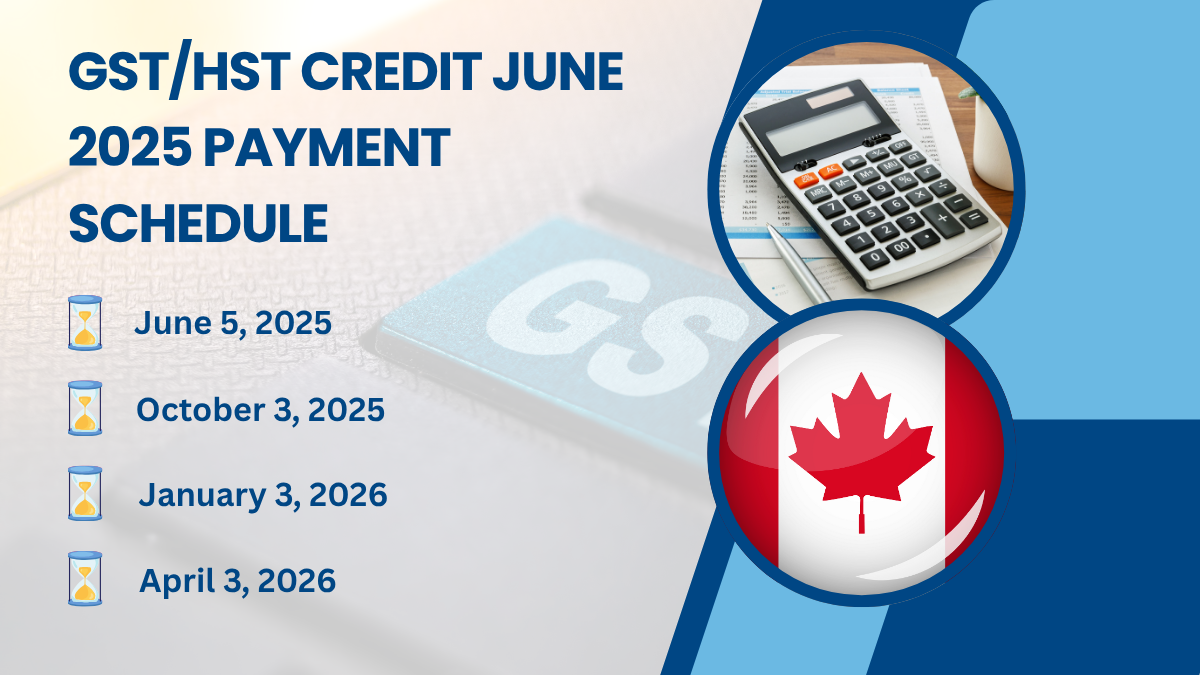

Understanding the full CRA June payout schedule is key to planning your finances. The quarterly credit distribution generally follows a consistent pattern, and this year there is no exception. The scheduled payment dates for the upcoming benefit year are as follows:

These payments may seem small, but they add up over the course of the year, especially for families with children or individuals managing on a fixed income. It’s important to note that the June payment is not an advance rather, it’s the first official installment of the 2025–2026 benefit year. To avoid payment delays, make sure your bank account information as well as mailing address are up to date with the CRA.

You can verify and update this via the CRA’s secure online portal. With direct deposit, many recipients report receiving their funds by mid-morning on the scheduled payout date, which can be a financial lifeline for those living paycheck to paycheck.

Not everyone qualifies for the GST/HST credit, and that’s where much of the confusion lies. You must meet specific personal and income-related criteria to be eligible for the Canada GST/HST payment 2025. First and foremost, you must be a resident of Canada for tax purposes during the month prior to and at the beginning of the month in which the credit is issued.

You must also be at least 19 years old or meet additional eligibility conditions (such as having a child or spouse). Most importantly, you must have filed your 2024 tax return, even with no income. This requirement often catches many people off guard, especially students, newcomers, and seniors, who may assume that a zero-income status excludes them.

In fact, the CRA needs your return to assess your net family income and determine your payment amount. If you don’t file, you won’t get the credit — no exceptions.

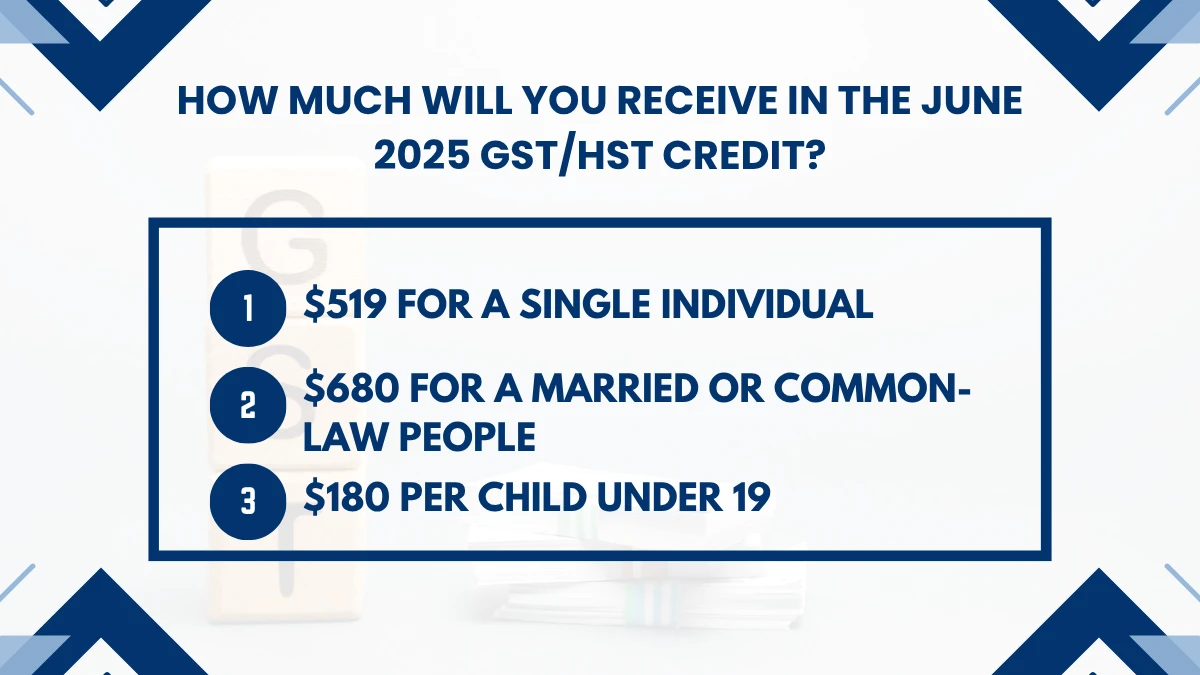

The exact GST/HST credit amount you receive in June 2025 will vary depending on your family size and 2024 income. The CRA adjusts these amounts annually to account for inflation. Based on previous figures and inflation indexing, here are the projected 2025–2026 maximum annual amounts:

$519 for a single individual

$680 for a married or common-law couple

$180 per child under 19

This would break down into quarterly payments of around $129 for singles, $170 for couples, and $45 per child. If your income exceeds the CRA’s threshold, your payment may be reduced or eliminated entirely. Conversely, those earning below the threshold may qualify for the full amount. The CRA will notify you of your eligibility and credit amount via a GST/HST credit notice that appears in your CRA My Account.

Don’t forget, changes to your family situation, such as a new child, marital status, or a drop in income, could significantly impact your payment. Make sure the CRA is informed of all such changes to ensure your payment reflects your current reality.

Filed Your 2024 Tax Return Yet? Time is Running Out

The number one reason eligible Canadians miss out on the June GST/HST credit is that they haven’t filed their tax return. While the official tax deadline was April 30, 2025, late filers can still receive the credit, but only if they act quickly.

If you file after the June 5 payout, your payment will be delayed until your return is processed. For example, if your return is processed in July, you may not receive your credit until the October instalment, leaving you without this important support for months.

The good news? You don’t need to do anything else besides filing. The CRA automatically reviews your return and calculates your benefit. No additional forms are needed unless you’re a newcomer to Canada, in which case Form RC151 is required. If you’re unsure whether your return has been received or processed, you can check the status in CRA My Account.

If June 5 passes and there’s no payment in your account or mailbox, don’t panic — but do take action. First, log in to your CRA My Account and check the status of your GST/HST credit. If it says the credit has been issued but you haven’t received it, verify your direct deposit information or address.

Even a small mistake (like a typo in a postal code or bank account number) can delay your payment. If nothing appears in your account, your 2024 tax return may not have been processed yet. In that case, check your filing status or call CRA at 1-800-387-1193 for further clarification.

Note that CRA agents won’t investigate missing cheques until 10 business days have passed from the payment date, so be patient, but proactive. And always make sure your personal information is current with the CRA to avoid these issues in the future.

Receiving the GST/HST credit often means you qualify for other important CRA benefit payouts, but only if you file your return. These include the Canada Child Benefit (CCB), the Canada Carbon Rebate, and in some cases, provincial or territorial supplements. In fact, the simple act of filing your taxes annually is what unlocks access to most government financial assistance programs. Many people aren’t even aware they’re eligible for these additional payments. Seniors will qualify for the Guaranteed Income Supplement, students may receive refundable tax credits, and newcomers may access first-time benefits through proper documentation. That’s why staying tax-compliant and filing on time is critical.

Navigating the CRA system, understanding benefit eligibility, and ensuring your tax return is filed properly can feel overwhelming especially if you’re new to Canada, behind on your taxes, or unsure what credits you’re entitled to. That’s where Aone Outsourcing Solutions makes all the difference.

We specialise in helping individuals, families, and small business owners across Canada stay compliant with CRA requirements, so you never miss out on vital credits like the GST/HST Credit, Canada Child Benefit, or Canada Carbon Rebate. Our experienced team in Canada takes the guesswork out of tax filing by preparing and submitting your 2024 tax return accurately, on time, and with every eligible benefit claim included.

Here’s how we help:

With Aone Outsourcing Canada, you’re not just filing a tax return, you’re unlocking the benefits you’ve earned. Let us handle the paperwork, deadlines, and CRA communication, so you can focus on living your life with the financial support you deserve.

The CRA benefit payout for the GST/HST credit is scheduled for June 5, 2025. This is the first payment of the new benefit year (July 2025 to June 2026) and is based on the information in your 2024 tax return.

To be eligible for the Canada GST/HST payment 2025, you must:

Be a Canadian resident for tax purposes

Be at least 19 years old (or have a spouse/common-law partner or child)

Have filed your 2024 tax return, even with zero income

Fall within the CRA’s income threshold for eligibility

No. You must file your 2024 tax return to receive the June 2025 GST/HST credit. If you file after the deadline, your payment will be delayed until your return is assessed by the CRA.

The CRA typically issues the GST/HST credit every quarter. The payment dates for the 2025–2026 cycle are:

June 5, 2025

October 3, 2025

January 3, 2026

April 3, 2026

Make sure your banking and address details are updated with the CRA to avoid delays.

Payment amounts depend on your net family income from your 2024 return. Estimated maximum annual GST/HST credit amounts are:

$519 for individuals

$680 for couples

$180 per eligible child

The June payment will typically be 1/4 of your total annual credit.

Check your CRA My Account to confirm:

If it’s been more than 10 business days and you still haven’t received anything, contact the CRA at 1-800-387-1193.

Yes — but you must:

Be a resident of Canada

File your 2024 return

Complete Form RC151 – GST/HST Credit Application for Individuals Who Become Residents of Canada

Aone Outsourcing Solutions can help you complete this process smoothly and claim your credit.

No. The GST/HST credit is non-taxable. It does not affect your income tax return or other federal/provincial benefits you may receive.

Yes, but direct deposit is faster and more secure. If you prefer a paper cheque, make sure your mailing address is up to date with the CRA. Keep in mind that cheques may take longer to arrive, especially in remote areas.

Aone helps you:

With Aone, you get peace of mind — and every dollar you’re entitled to.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .