GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

In the contemporary realm of Canadian accountants, there is a growing demand and pressure to provide prompt, accurate, and compliant financial services to the ever-changing regulatory environment. Whether it is dealing with the complex tax legislation, any number of changing GST/HST tax rates, heavy volumes of business, and short deadlines, it is getting harder and harder to make a mistake, and the expectations of clients are increasing.

Even such small disorganizations may be disastrous in such a dynamic setting: missed filing, incorrect reporting, CRA fines, and lost client confidence. Odds are that you work either with a small business, start-up or big business and that you need a system that makes it all work - hour after hour, day after day, week after week, month after month.

Planned checklists enter the picture at that point. Crafted accounting checklist is not a routine; it is your primary preventive measure against mistakes, omissions, and inefficiency. It introduces a course into day-to-day doing, automates routine procedures and ensures no nook or cranny is neglected during the rush periods. What is more important, it enables you to remain audit-ready, client-oriented, and comfortably confident in CRA compliance.

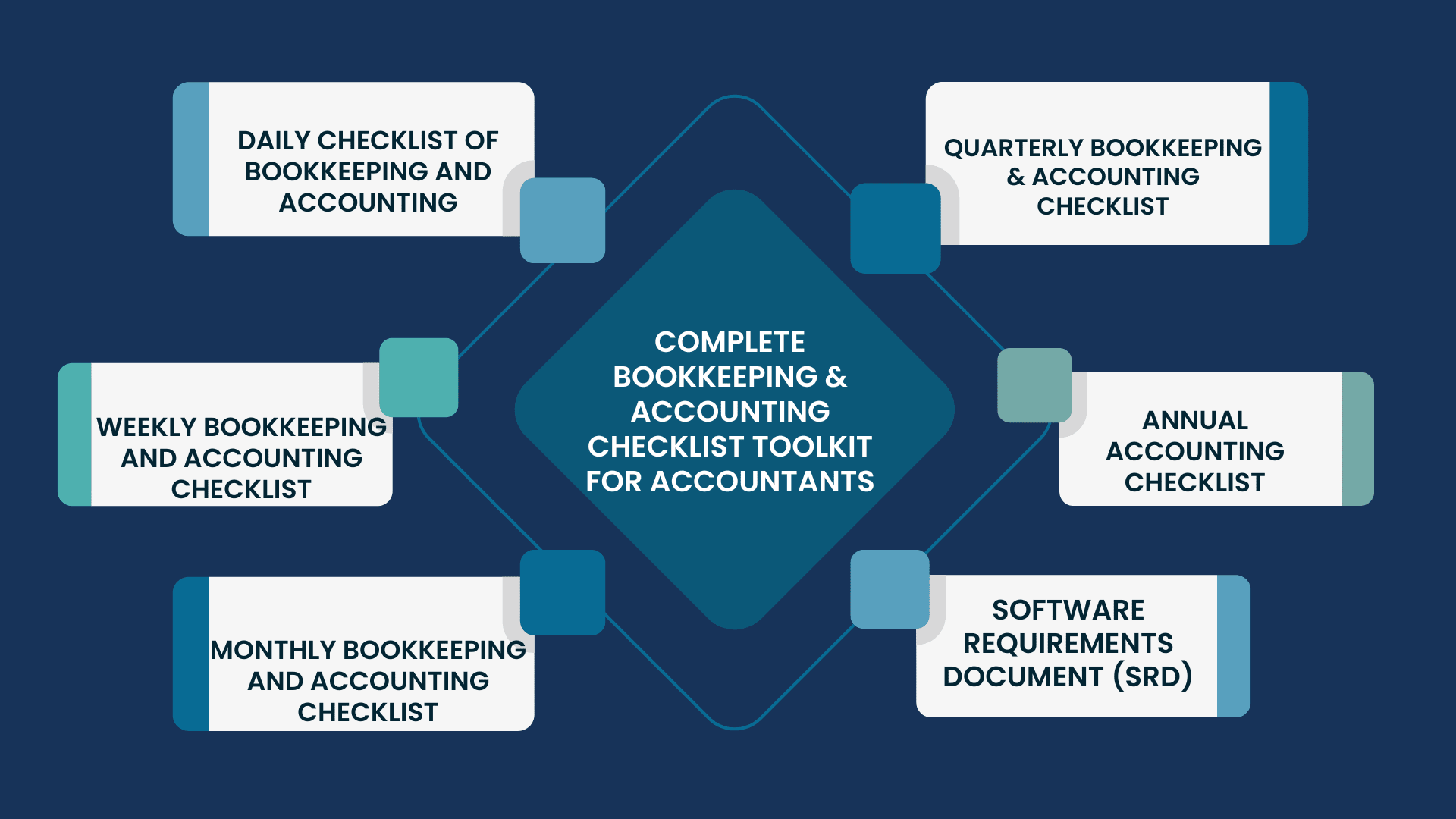

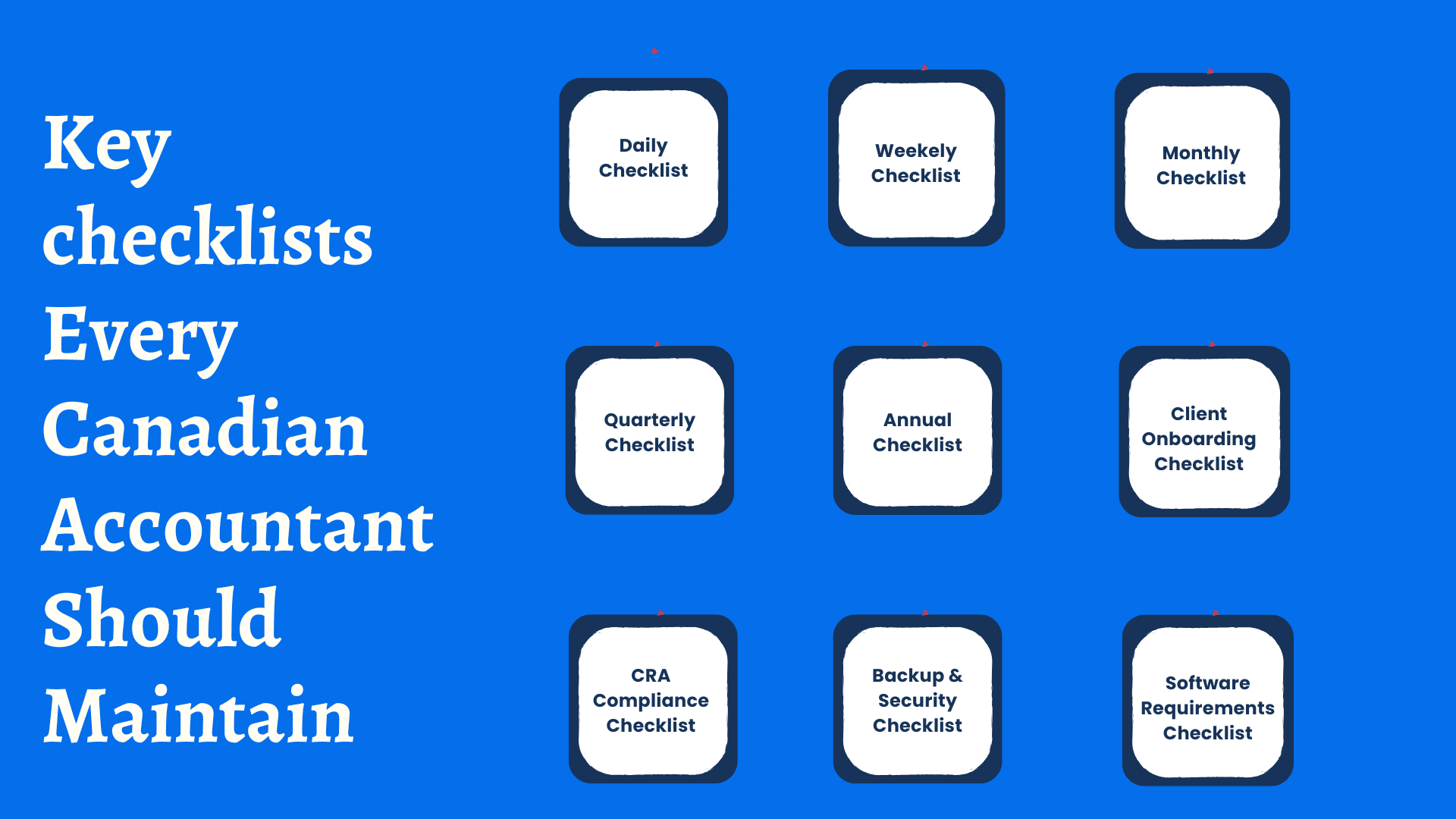

This blog presents a Canadian version of the Complete Bookkeeping & Accounting Checklist Toolkit, which helps accountants and bookkeepers do their work. Whether daily or at the end of the year, this toolkit will enable you to:

Be well-organized with a well-marked working cycle.

Do not miss any monthly and annual tax payments.

Make sure that the Canadian standards of accounting and taxes are met.

Be more efficient, do less work on rework, and increase client satisfaction

No matter whether you handle individual accounts or supervise a whole accounting department, it becomes your silver bullet in the operations and the stress-free management of finance.

A healthy daily workflow allows spotting a potential blind spot in the budget, avoiding delays and mistakes. These activities will make sure that the books of your clients remain up to date, well-profiled, being ready to be scrutinized or reported upon at any moment.

Record Transactions: Enter all the incoming and outgoing transactions, sales, purchases, and bank activities using the accounting software of the client.

Match Receipts & Invoices: Create digital copies of receipts and associate them with corresponding transactions so that proper documents are kept and ready to face an audit by the CRA.

Follow the Cash Flow: This is a pretty simple one; you just need to make sure you are watching your cash inflow and outflow so that you have enough to operate daily, and when you want to pay, you have some on hand to take care of this.

Ask Client Documents: Be on the lookout for missing documents such as sales records, expense receipts or payrolls and follow up on clients with reminders.

Respond to Client Requests: Address the urgent inquiries or notices of clients concerning payment, CRA, or system access in a professional and educated manner in the shortest possible time.

Backup Accounting Data: Daily backup should be made of the accounting files and relevant supporting documents securely to guard against any accidental loss of data.

Team Task Review: Apply a team check-in or update the task boards and keep the team accountable and on track with shared goals.

A walkthrough every week is one way of having a checkpoint to detect errors, balance books, and maintain a smooth-running client operation. These repeated duties help to manage the cash flow and clean documentation.

Reconcile Bank Feeds: Review and match imported bank transactions and bookkeeping items, and rectify any differences or duplicates.

Follow-Up on Invoices: Check the accounts receivable report, and send account reminders or follow-ups where invoices are overdue or missing.

Bills & Payments Processing: Go through the bills received by various vendors, approve the payments to them and enter the same into the system with relevant details.

Process Reimbursements: Check and process the reimbursement of employees based on their expenses or a reimbursement of a client based on their mileage, travel, or supplies.

Post Journal Entries: At every week, enter payroll expenses, petty cash use, or any reconciliation that they think is a correct statement of financial position.

Manage Financial Records: All the financial documents, such as receipts, invoices, and reports, must be properly sorted and organized in a secure, searchable program.

The tasks of financial accuracy, timely reporting, and tax compliance operate every month. By doing so, books can be clean, client molecules can be acted upon, and deadlines never forgotten, in case of GST/HST/PST filers.

Close Financial Accounts: Clear and reconcile all bank, credit card, and loan account balances as against the accounting records in finding and settling any discrepancies.

Final Journal Entries: Post monthly accruals, depreciation and other adjustments to give the true financial performance.

Financial Reporting: Generate and review important statements such as profit & loss, balance sheet and cash flow to understand the health of a business.

File GST/HST/PST Returns: File the necessary sales tax returns on behalf of the client and make timely payment to the government to eliminate the penalty.

Review Aging Reports: Analyze accounts receivable and payable aging to follow up on unpaid invoices and manage outstanding liabilities.

Backup Monthly Reports: Store and backup all completed reports and reconciliations, and secure folders on file to be audit-ready and accessible in the future.

The quarterly reviews provide a strategic picture of the business and assist in decision-making. Not only are these activities related to bookkeeping, but they also prepare clients to comply, budget, and plan the future.

Filing of Quarterly GST/HST/PST Returns: Prepare and file necessary quarterly tax returns accurately, through proper reconciliation and compliance.

Interpret Trial Balances: Look into the trial balance to identify errors or unposted entries and effect such entries as necessary to keep the ledgers clear.

Review Payroll & CRA Remittances: Audit payroll records to verify that the compensation has been withheld to CRA properly and adjust over/under withholding.

Budget vs. Actuals Comparison: Analyze performance against its client budgets and provide insight on variances to aid in financial planning.

Measure Profitability: Evaluate the net earnings, margin, and cost trajectory to gauge quarterly improvement and performance.

Prepare Advisory Meetings: Put reports and talking points together to talk to the clients, give them feedback and suggestions on their strategy.

An accounting checklist helps annual tax compliance, performance reporting, and lays the basis for the following financial year. These activities will make the financial year close correctly and within the rules directed by CRA.

Complete Financial Statements: Complete the year by making the final P&L, balance sheet and cash flow statements to be reviewed and submitted.

File and Prepare T-Slips (T4, T5, T5018): These are the tax slips that have to be generated and filed either by the employees, shareholders and subcontractors under the requirements of the CRA.

Make Year-End Tax Compositions: Compute T1 (sole proprietors), T2 (corporations), and T2125 (self-employed) and ensure they are done before the CRA deadline.

Archive Essential Documents: Keep year-end reports, ledger, receipts, and tax slips in a safe place for no less than 6 years, since the rules of CRA audit require retention of such records.

Post Year-End Adjustment: Adjust the accounting systems by accruing, reconciling the inventory, and recording depreciation to show the actual financial situation.

Book Yearly Client Appointments: A key strategy to stay on top of developments is to book annual appointments to review strategy with the client, covering tax planning, profit review and YoY improvement.

Selecting the appropriate accounting software is essential in order to organize everyday work and keep CRA compliant. You will want to have your toolkit support automation, security and collaboration.

Cloud-Based with Multi-Currency and Tax Compliant: Complete tax-compliant Sage, QuickBooks online, or Xero provide support on GST/HST/PST/Cross-border.

CRA Filing Integration: It would be important that you make sure that the software allows you to e-file GST/HST, T4S and returns either directly or through third-party add-ons.

Bank Feed Automation: According to facts and figures obtained, automate imports of bank and credit cards in real time, balancing and matching the transactions.

Invoice & Expense Tracking: Form, send and track your invoices; attach and code expenses easily.

Payroll & Tax Deductions: Process payroll figures, taxes and CRA payments with integrated or built-in payroll programs.

Data Security Features: Data security features can be prioritized, including: Require encryption, require two-factor authentication, and require role-based access.

Third-Party App Compatibility: Make sure it is easy to integrate with other tools such as Dext, Hubdoc, and Receipt Bank to ease document management.

Besides daily, monthly, and annual checklists, these are some major processes that can provide your accounting workflows with security, compliance, and client-readiness since day one. These checklists facilitate an easy onboarding process, data security, and the compliance of CRA.

A proper introduction sets an effective working relationship and prevents any delays in the documentation or work process in future.

Business and Tax Info Collection: Find out the legal names, BN, GST/HST entries and ownership information.

Program Installation and Permission: Install accounting software and exchange permission details safely.

Workflow Preferences: You must align your invoicing, payroll and reporting schedules with those of the client.

Legal Documents (NDA, Engagement Letter): Get signatures on legal documents and terms of service.

Custom Checklist Design: Create a customized checklist according to the industry of the client and the services provided.

It is not negotiable in terms of compliance. Such activities will prevent penalties and clean audit trails.

Filing Frequency Setup: Ensure that the client is determining the GST/HST/PST filing frequencies ( monthly, quarterly or annually).

Slip Preparation and Filing: Prepare and file T4, T5, T5018 and ROE slips within CRA deadline.

Examination of Tax Correspondence: Scan the CRA letters or notices and document them in the records of the client.

Filing Accuracy and Audit Preparation: Returns should be proofread, and documentation maintained that is ready to be audited.

Consistent Backup Schedule: Establish automation of daily/weekly backup in the cloud of all the files and reports.

Encrypted Storage and Access Control: Access restricted data through the role-based encrypted folders.

Antivirus and Software Audits: Regular malware scans and system audits should be done to prevent breaches.

User Permission Management: requires other staff to have less access to sensitive information about clients.

A structured checklist is not merely a method of organization but a necessary element in providing accurate, efficient, CRA-compliant bookkeeping and accounting services. In any firm, be it in doing daily arrangements, monthly book closure, or year-end reporting, a step-by-step operation is followed to ensure that nothing is left out.

Considering such an approach on all levels, irrespective of the time, you will not only increase client satisfaction but also optimize internal processes, minimize mistakes, and always be ready to audit and meet any deadline in one year.

Are you ready to enhance your workflow?

Begin implementing these effective checklists in the day-to-day operations of your firm and feel the difference in terms of accuracy, efficiency and also client confidence.

Have doubts or need help with your accounting workload?

Contact Aone Outsourcing now and find out how our professional staff can make your bookkeeping activities more efficient in Canada.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .