GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Tax season in Canada is an important time for every individual and business. Knowing when are taxes due in Canada and when are taxes due 2025 Canada is the first step towards avoiding penalties, gaining access to benefits and refunds, and making sure your returns are accurate and timely.

The CRA tax return dates isn’t just a single date, it’s a series of important milestones that can affect every part of your financial planning for the year. In this blog, we break down the five key 2025 CRA deadlines, explaining precisely when taxes are due in Canada, when you can file your taxes, and why these dates matter.

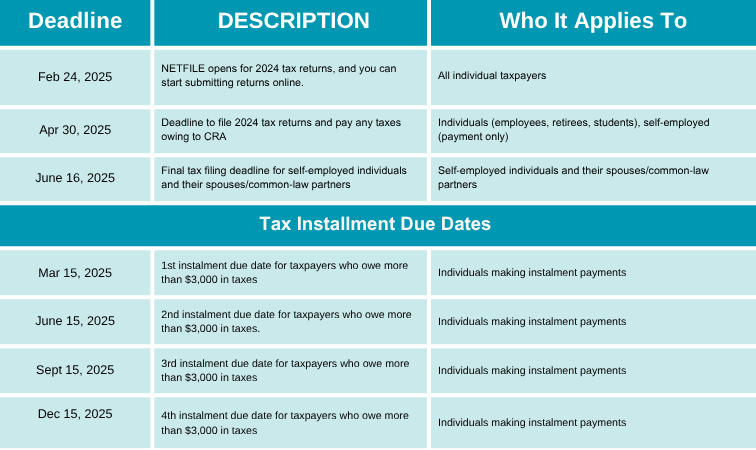

Stay compliant and avoid penalties by knowing these important tax deadline 2025 in Canada. Here’s a quick reference table of all the key deadlines every individual, self‑employed person, and business owner needs to mark on their calendar. These include the deadline for tax return in Canada and other critical CRA tax return dates for 2025.

For many Canadians, one of the biggest questions at the start of the year is: “When can I file my taxes?” The CRA opens its NETFILE service for 2025 returns on February 24, 2025. This date marks the official start of tax season, allowing individuals and businesses to electronically file returns for the 2024 tax year.

Filing early has its benefits. Not only does it give you a head start, but it also allows the CRA to review your return promptly, which can result in a faster refund if one is due. According to the CRA, returns submitted electronically often have refunds issued within 8–10 business days for those using direct deposit. So if you’re thinking to get your money back quickly, mark February 24 in your calendar.

The most important date for individual taxpayers in Canada is April 30, 2025. This is the CRA’s official deadline for submitting your ncome tax return of 2024 and making any payments you owed.

If you miss the April 30 deadline doesn’t just mean submitting your return a little late, it can have serious financial consequences. The CRA applies a 5% late‑filing penalty on the balance owing if you miss the deadline, with an additional 1% per month added for every month your return is late (to a maximum of 12 months). In other words, a delayed submission can quickly balloon into a costly error.

Even if you don’t have the money available to pay your taxes right away, it’s vital to file your return by April 30. The CRA allows taxpayers to set up a payment arrangement for any of the amounts owing. By doing this, you can reduce penalties and interest which will help you maintain compliance with CRA regulations.

If you’re self‑employed or if your spouse or common‑law partner operates a business, your deadline for submitting a tax return is June 16, 2025 (since June 15 falls on a Sunday).

While this gives you additional time to review your income, expenses, and deductions, one crucial fact often overlooked is that you must still pay any taxes owing by April 30, 2025. The CRA applies daily interest charges to any balance owing after that date. This means that although you have more time to file, it’s wise to estimate your tax liability and pay it by the April deadline if you want to avoid interest charges.

This extended deadline is ideal for self‑employed people and businesses that require more time to review and finalise their returns, especially if you have a more complex tax situation. However, making payments by April 30 is the best practice for avoiding interest penalties.

For businesses operating as sole‑proprietorships or partnerships (and where the fiscal year ends on December 31), the deadline is also June 16, 2025. The CRA allows businesses that align their fiscal year with the calendar year an extended period for submitting returns, making it an ideal option for entrepreneurs and small businesses.

If your business has a fiscal year that doesn’t end on December 31, the ( Canada Revenue Agency ) CRA deadline is six months after your fiscal year-end. But no matter when you file, any taxes you owe must be paid by April 30, 2025 to avoid interest and penalties.

For the estate of a person who has passed away, the CRA applies special deadlines that depend on the date of death.

If death occurs between January 1 and October 31, 2024, the final return is due by April 30, 2025.

If death occurs between November 1 and December 31, 2024, the final return is due six months after the date of death.

For self‑employed deceased individuals, the return is due by June 16, 2025, although any taxes owing must be paid by April 30, 2025. Filing your final return within these deadlines is vital for the orderly settlement of the estate and to ensure that benefits and credits can be claimed properly.

Staying on top of CRA deadlines is one thing, but making sure every dollar is accounted for, every deduction is claimed, and every return is error‑free is another. At Aone Outsourcing Solutions, we understand how challenging and overwhelming tax season can be, especially when you’re running a business, managing a side hustle, or dealing with complex personal tax situations.

With a team of experienced tax professionals and certified bookkeepers, we’ve been helping businesses and individuals across Canada file their taxes accurately, on time, and with maximum benefits for years. Here’s how Aone can support you throughout the 2025 tax season and beyond:

We track every CRA deadline for you from February 24 NETFILE openings to the final June 16 self‑employed due date, so you never have to worry about missing a date. Our team ensures returns are filed and payments made correctly, avoiding penalties and interest charges.

Every person and every business is unique. Aone takes the time to understand your circumstances, providing tailored tax planning, preparation, and filing services that align with your financial situation. We help claim every deduction, credit, and benefit available to minimise your tax burden and optimise your refund.

For small businesses and self‑employed professionals, we understand how vital it is to balance CRA compliance with operational demands. Aone provides seamless bookkeeping, GST/HST returns, payroll services, and corporate tax preparation, allowing you to focus on growing your business while we handle the tax complexities.

Have a notice from the CRA? Need help with an audit or review? Aone acts as your trusted CRA liaison, responding to requests, providing accurate documents, and supporting you every step of the way.

Taxes aren’t a one‑time annual event. We work with you year‑round, offering planning and forecasting services to reduce liabilities and save money, making sure you’re always positioned for success when it’s time to file.

At Aone Outsourcing Solutions, our mission is simple: to help you stay compliant, save money, and make the CRA work for you. Whatever your needs, whether you’re an individual, self‑employed, or managing a growing business, our team is here to make the 2025 tax season stress‑free, seamless, and rewarding.

The 2025 tax filing season is about more than submitting returns; it’s about understanding the critical deadlines and aligning your financial planning accordingly. From knowing when taxes are due in Canada to making payments and submitting returns, these deadlines matter for every individual, self‑employed person, and business owner.

By being proactive, submitting returns on time, making payments promptly, and seeking expert help when needed, you can save money, reduce stress.

If you’re unsure about your specific tax situation, consider taking help from a tax professional who can guide you through the process and help you make the most of available benefits, deductions, and credits. Remember: The CRA’s due dates aren’t just about avoiding penalties. They’re about making sure you claim every dollar you’re entitled to, submitting accurate returns, and setting yourself up for financial success throughout the year.

If you’d like to learn more about how we can support you with your CRA tax filings and planning, get in touch with us today. Let’s make sure this tax season works in your favour!

The CRA will open its NETFILE service for 2024 tax returns on February 24, 2025. From that date, you can electronically file your taxes for the 2024 tax year and, if applicable, receive your refund within as little as eight to ten business days when using direct deposit.

For most individual taxpayers, the deadline for submitting your tax return is April 30, 2025. This applies to employees, retirees, and students. If you’re self‑employed or have a business, you have until June 16, 2025, although any taxes owing should be paid by April 30, 2025.

If you’re self‑employed or have a spouse/common‑law partner who is self‑employed, you must file your return by June 16, 2025. However, if you owe any taxes you must pay it by April 30, 2025, regardless of your filing date. This allows you more time for preparation, but interest will accrue if payments aren’t received by the April deadline.

If you miss the tax filing deadline, the CRA will charge a 5% penalty of your balance owing, along with an additional 1% per month (to a maximum of 12 months) until your return is submitted. Late payments also accrue daily interest, making it vital to file and pay on time, or to set up a CRA‑approved payment plan.

For businesses that operate on a calendar‑year basis, the corporate tax return must be filed by June 30, 2025 (six months after year‑end). If your business has a different fiscal year‑end, the CRA deadline is six months after that date. The deadline for making any payments, regardless of your fiscal year‑end, is always two months after the end of that fiscal period.

If an individual passed away between January 1 and October 31, 2024, the final tax return is due by April 30, 2025. If death occurred between November 1 and December 31, 2024, the deadline is six months after the date of death. For self‑employed individuals or those with self‑employed spouses, the tax return is due by June 16, 2025, although any taxes must still be paid by April 30.

If your estimated taxes for the year exceed $3,000, you may be required to make quarterly instalment payments. These payments are due by March 15, June 15, September 15, and December 15 of every year. Making these payments can save you from interest charges and penalties at tax time.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .