GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Every dollar and every minute are essential in the fast-paced contemporary business climate of Canadian society. A finance department often struggles to achieve more with less, resulting in a significant emphasis on operational efficiency and resource utilization planning. Sales and marketing tend to take center stage, but the mundane aspects of Accounts Payable (AP) stand to unlock enormous opportunities in terms of monetary returns and risk minimization.

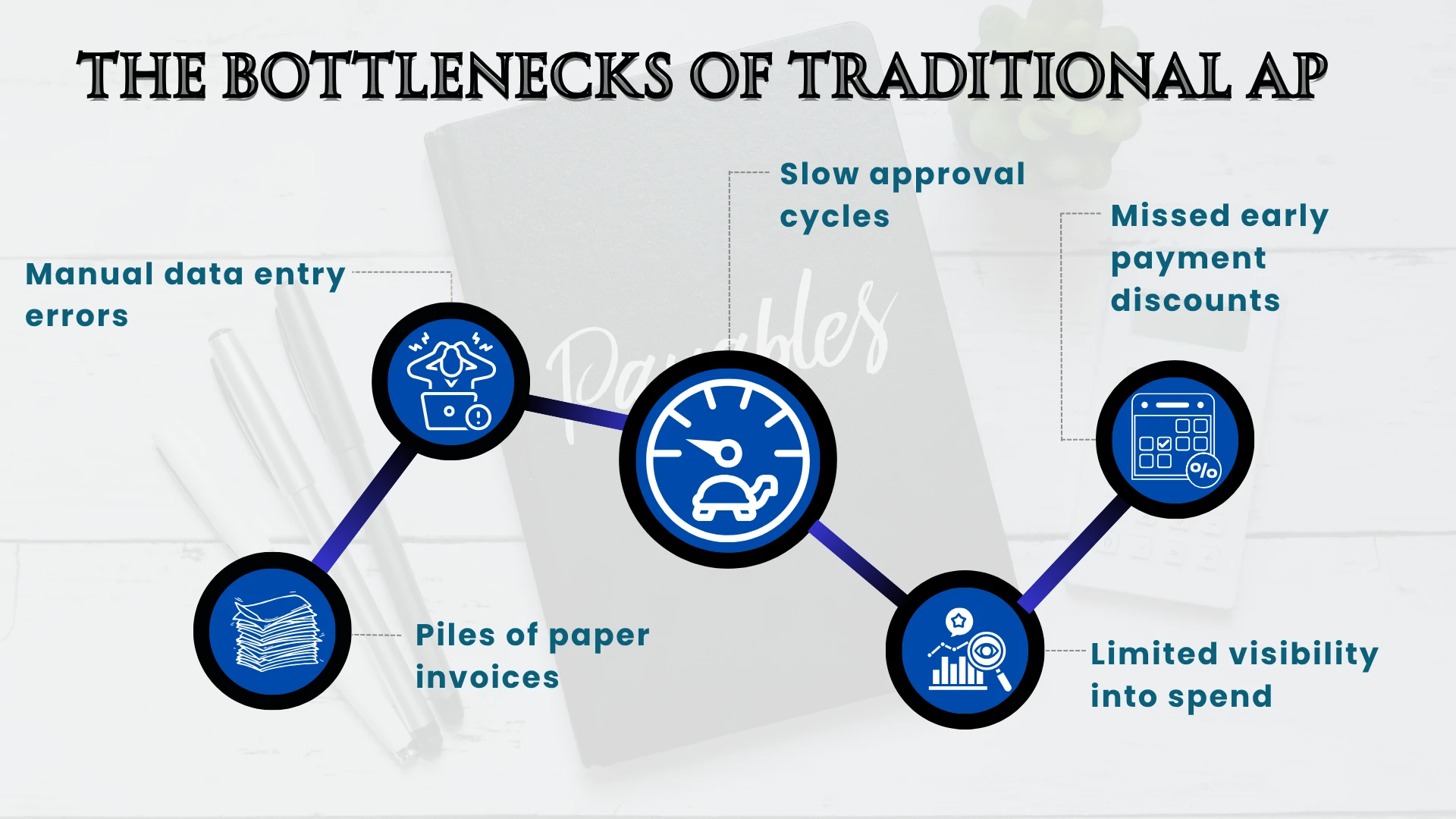

AP is a manual and paper-based workflow riddled with inefficiencies, errors, and lost opportunities for most Canadian organizations. Such a classical method may result in expensive delays, strained relations with suppliers, and the inability to view important spending details. The fact is that it has been pointed out that manual AP processes would cost businesses between $15 and $20 per invoice. Consider that on a scale of hundreds or thousands of invoices each month!

This is precisely why accounts payable outsourcing has become a game-changer. Canadian businesses can outsource AP management to third-party specialized accounts payable outsourcing companies or specialized accounts payable outsourcing providers. These accounts payable outsourcing services are not merely entry-level data input businesses, but rather full-service solution providers, paralleling AP automation and facilitating the actual efficiency of finance functions.

The objective is simple: make your AP department a strategic asset rather than a cost center. Let's explore the five crucial steps that the best outsourced accounts payable services carefully handle, all of which are designed to provide Canadian businesses with levels of efficiency and control that have never been achieved before.

Optimizing the Accounts Payable process involves a series of interdependent, well-defined steps. These are how the top suppliers change this crucial financial process:

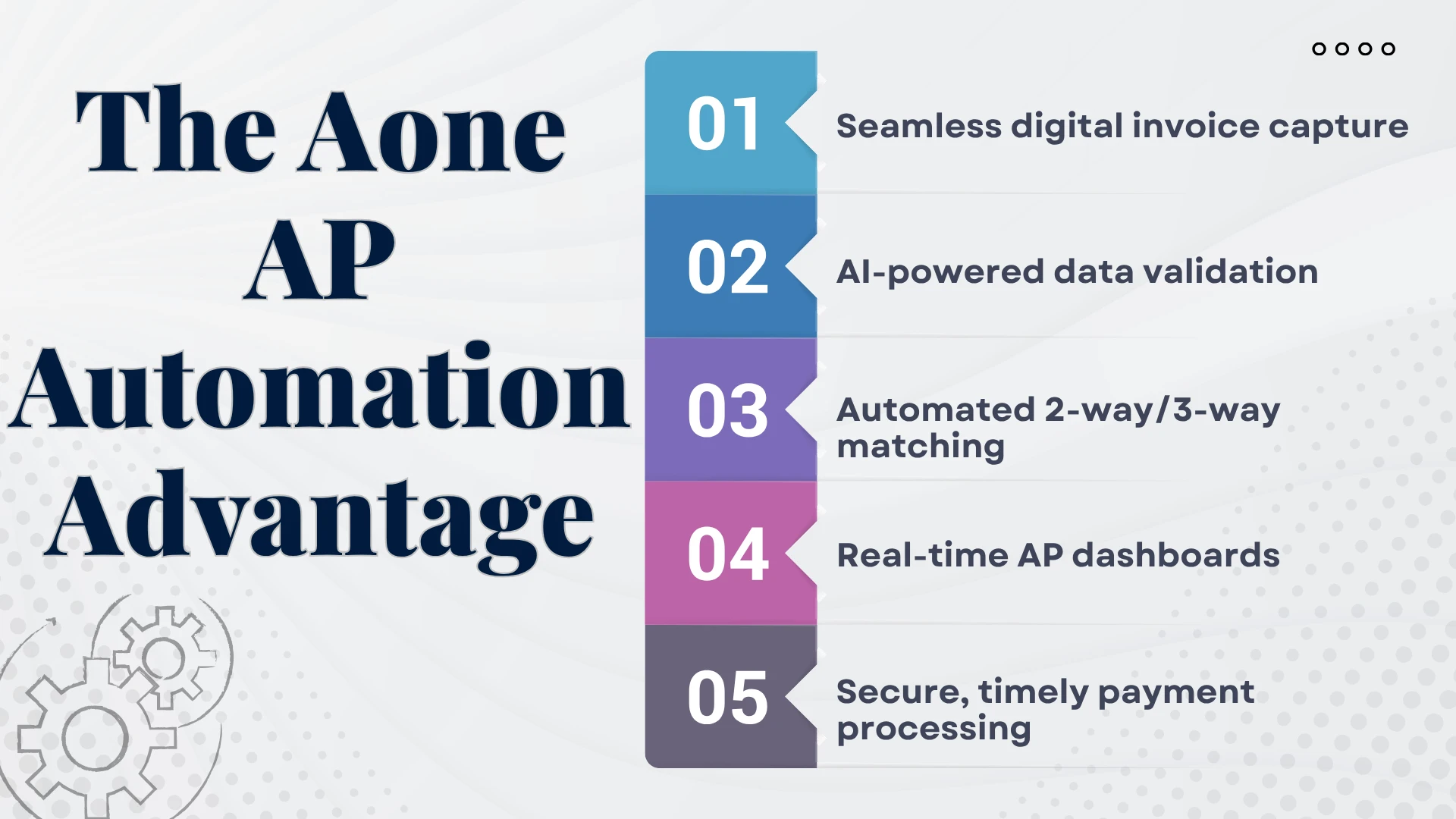

Efficient AP is based on how invoices are entered and processed within your system. The old ways are associated with piles of papers, keying, and an error-prone process. Accounts payable outsourcing providers propose highly innovative digital devices to reengineer this front-line stage.

Multi-Channel Invoice Ingestion: Invoices in mail and vendor portals are captured in a centralized system. This consolidates all inputs into a single digital stream, thereby eliminating the need for piecemeal documents.

AI-Powered Data Extraction & Validation: OCR and AI are utilized to extract and validate critical data values, including vendor, amount, due date, and Canadian GST/HST information. This saves a significant amount of time that would have been wasted on data entry, and it is accurate from the moment of its creation.

Automated Matching & Discrepancy Flagging: Automatic matching of invoices with purchase order and goods received note (two-way or three-way matching). Any mismatch can be easily identified as an "exception," and no erroneous payments can be made, which facilitates accounts payable reconciliation.

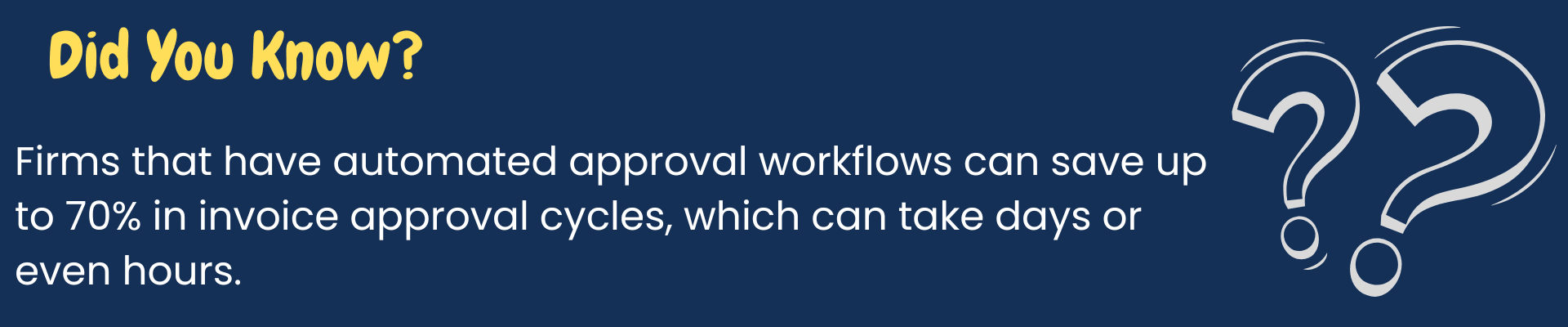

After capturing an invoice and validating it, it requires approval. The notation step tends to be a critical bottleneck in manual AP systems, representing a potential cause of delayed payments to suppliers and even a negative relationship with them. Dynamic rule-based workflows of accounts payable outsourcing services are provided to you with approval processes that are tailored to your organization and Canadian compliance rules.

Customizable Workflow Automation: Invoices are sent to the relevant approvers based on predefined rules, such as amount limits or department. This eliminates the time-consuming process of physical routing, making approvals faster.

Real-time Visibility & Alerts: Approvals are notified in real-time and can access and approve bills from anywhere and on any device. The use of dashboards enables the viewing of status updates and the prompt response to potential delays.

Brilliant Exception Handling is a process where, when an exception is detected (e.g, invoice does not match PO), the system can be set up, in advance, to initiate a designated process to resolve it quickly. This proactive approach reduces the number of late payments and helps maintain good relationships with vendors.

Effective Accounts Payable means more than just receiving and paying invoices; it involves developing strong, transparent relationships with the suppliers you purchase from. Manual AP creates the tendency toward vendor queries on payment states, which wastes precious time for both sides. Outsourcing accounts payable transforms this process into a professional, self-sufficient operation.

Centralized Vendor Master Data Management: Valid and current vendor Master data, including contact information, payment terms, bank details, and Canadian tax numbers (such as GST/HST numbers), are stored. This ensures data integrity and meets Canadian tax reporting requirements.

Proactive Vendor Communication: Vendors can utilize secure online portals to view the real-time status of their invoices, resulting in fewer inbound inquiries for your finance department. This encourages openness and develops integrity.

Payment Term Optimization: Close monitoring of payment terms enables the system to identify potential opportunities for receiving a down payment discount. This brings direct savings to your bottom line, guaranteeing on-time payment and preventing late fees.

Invoice receipt is a crucial end of the AP process. This is an operation that should be carried out with precision, safety, and the right strategic timing to maximize cash flow.

Strategic Payment Scheduling: Your payments will be structured to align with your organization's cash flow strategy, ensuring timely bill payments without overleveraging capital. This may include prioritizing payments to part suppliers or offering discounts to all suppliers.

Multi-Method Secure Disbursements: Multiple outsource providers manage secure payment with multiple means, including EFT to Canadian bank account, virtual credit card, or physical cheques. To ensure security and prevent fraud, they adhere to strict security protocols that safeguard sensitive banking information.

Smooth Bank Reconciliation: Automatic matching of outgoing payments with bank statements simplifies the post-payment reconciliation of accounts payable. This ensures precision in the recording and balancing of all transactions, making the month-end closing processes more efficient.

In addition to transactional benefits, the real value of accounts payable outsourcing lies in its unrivalled visibility, which provides a deeper understanding of financials and enhanced compliance. This is a crucial step in strategy decision-making and sound governance.

Continuous and Automated Reconciliation: Automated systems continuously reconcile your AP ledger to vendor statements and bank documents. This preemptive design and fix eliminates inconsistencies in real-time, significantly reducing data errors.

Extensive Financial Reporting: Get access to customizable dashboards and reports with in-depth analysis of spending, outstanding debts and history of payment. Such KPIs as cost per invoice and early payment discount become easily accessible.

Perfect Audit Trails and Compliance: All actions are logged and time-stamped, leaving a complete and unalterable audit trail. This also ensures full transparency during internal or external audits, particularly when there is a need to demonstrate GST/HST compliance to the Canada Revenue Agency (CRA).

In the case of Aone, we understand that Australian enterprises face distinctly different challenges from those in Canada, including specific tax-related accommodations, notably GST/HST, as well as various provincial requirements. We not only offer outsourcing of accounts payable, but we are also a strategic partner who believes in your financial success and transformation in the digital world.

This is the way Aone can provide unbeatable value to your business:

Experience in the Canadian Market: Our team is well-versed in Canadian tax regulations, regulatory requirements, and business considerations. This makes sure that your AP operations are compliant at all times and streamlined to the local landscape.

Solutions that Fit Your Business: We tailor our solutions to your systems and specific business requirements, ensuring they meet your unique needs. We provide you with flexible, scalable support explicitly tailored to your needs.

State-of-the-Art AP Automation: Take advantage of the latest in AI, OCR and Cloud technology to automate up to 90 percent of your AP processes. This saves a significant amount of time spent on manual handling and reduces human errors.

Cost Savings and Efficiency: We achieve an average savings of 30-50 percent on AP processing for our clients. This is coupled with faster cycle times, increased accuracy, and improved cash management.

Focused Support and Openness: You will have a team of experienced AP professionals to support your every need. You will also receive daily reporting and complete openness to your AP process through user-friendly dashboards.

Enhanced Security and Anti-Fraud Measures: We employ bank-level security protocols, multiple authentication methods, and robust internal controls. This protects your financial information and takes active preventive action against fraud, so you don't have to worry.

Collaborate with Aone to reduce the transactional load of AP and leverage it as a growth and profit driver.

The competitive Canadian business environment of 2025 and beyond requires agility, efficiency, and power in financial management. Manual Accounts Payable procedures are no longer viable. They consume resources, generate inaccuracies and hide essential financial insights. Accounts payable outsourcing has the potential to transform the back-office operations of Canadian businesses.

More than just the act of delegating tasks, it is also a strategic move towards financial efficiency, cost-cutting, and a more secure future. Intelligent invoice processing and automated approvals, detailed vendor management, and real-time reporting are the five key steps that skilled accounts payable outsourcing providers address, paving the way to unmatched operational excellence.

Inefficient AP should not be holding your business back. The key to making your accounts payable work more effectively is to leverage the power of outsourced accounts payable services, integrate them fully into your operations, enhance compliance and cash flow, and eliminate distractions by empowering staff to focus on what truly matters in your business.

The procedures include processing, recognizing valid ones, and matching them with purchase orders. This is then followed by internal approvals, payment scheduling, execution, and reconciliation.

Outsourcing Accounts payable is transferring functions associated with AP to a third party. AP automation helps them with the processing, approval, and payment of invoices, as well as reconciling vendor payments.

Standardize invoices coming in, automate the approval process, update data about vendors and ensure streamlining of payment schedules to manage AP. Outsourcing accounts payable services can introduce significant efficiency.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .