GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Most businesses in Ottawa have faced a setback to their operations due to increased financial compliance requirements. Maintaining books is still challenging due to time and skill deficiencies. In the absence of quality bookkeeping services in Ottawa, errors would accumulate, and decisions would be made hastily, ultimately negatively impacting auditing preparedness.

Another significant challenge is making timely and proper payments of taxes to Ottawa. The ever-changing rules and complex obligations of the CRA can lead to overlooking deadlines or filing inaccurately, which can attract penalties or audits. Similarly, the regulation of payroll services in Ottawa involves calculating deductions, filing T4S, and complying with the CRA, which necessitates careful attention.

Correct GST Ottawa reconciliation is also a challenge to businesses in Ottawa. Improperly filed documents or failure to claim input tax credits may affect cash flow and attract the attention of the CRA. Moreover, full-time accounting employees can be pretty expensive and, in most cases, unnecessary for small-to-medium-sized companies.

Although there are several accounting firms in Ottawa, most of them do not offer affordable and tailored services to expanding firms. This has been a challenge in getting reliable accounting services in Ottawa, and more businesses are turning to outsourcing as a scalable and smart idea.

As the demands of financial and compliance requirements continue to grow increasingly complex, more businesses in Ottawa are considering more innovative options for hiring directly in-house. Outsourcing is a modern alternative that saves money while enhancing efficiency and accuracy. Outsourcing means that your payroll, tax reconciliation, monthly books, or other financial activities will be handled by professionals who know how to do them proficiently. You also avoid the long-term costs and commitments associated with any employee.

The reason outsourcing is turning out to be a wise business decision in Ottawa is as follows:

The overhead cost of employing full-time employees, such as salaries, benefits, and office rent, is waived through outsourcing. This will make accounting services in Ottawa more acceptable and viable to most businesses, including SMEs.

Ottawa companies have the opportunity to harness a group of skilled professionals in various accounting functions, such as bookkeeping, taxation, and financial reporting, thereby avoiding the time-consuming process of hiring talent and providing subsequent training.

Quality outsourcing will also ensure that essential tasks, such as payroll services in Ottawa, GST/HST reconciliation, and Ottawa tax filing, are completed on time and accurately, thereby preventing fines from the CRA and ensuring a smooth process.

Service providers who offer outsourcing services only concentrate on accuracy and compliance in finance. Their professionalism minimizes mistakes in Ottawa bookkeeping and enables the maintenance of clean books, ready for audit.

Whether your business is expanding, seasonal, or newly begun, outsourcing allows your service delivery to be tailored to your specific requirements. You are also in a position to add or drop support in bookkeeping, Ottawa tax returns, or payroll services without any fuss.

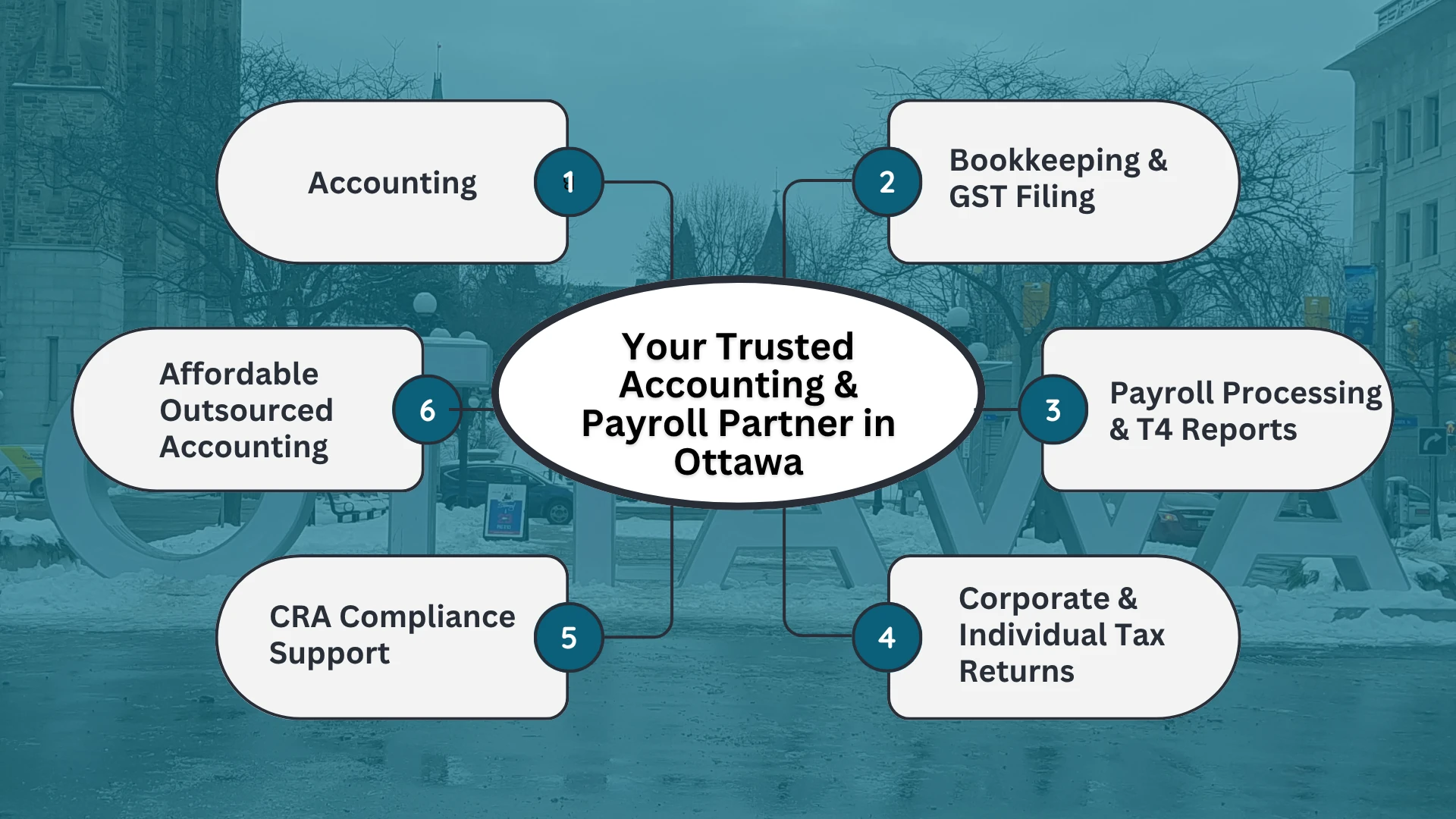

Aone Outsourcing offers comprehensive financial services packages tailored to meet the demands of businesses in the Ottawa area. As one of the reputable accounting companies in Ottawa, we offer dependable, affordable, and scalable services to meet your daily and annual financial needs.

We maintain clean, accurate, and timely accounting records, relieving you of the task of managing your business. Our bookkeeping services in Ottawa help you make informed decisions and ensure audit preparedness.

We also handle invoice processing, pay our vendors, and manage cash flow to ensure that your business avoids late penalties and maintains a healthy supplier relationship.

Our services ensure timely invoicing and follow-up with your customers, helping you increase your cash flow and reduce the number of outstanding accounts.

We will be ready to file the correct Ottawa tax returns, both for individuals and businesses, to ensure that you do not encounter trouble with the CRA tax payment sections.

Whether it's payslips, T4S, CRA remittances, and more, our payroll services in Ottawa are adherence-compliant and guarantee the timely and correct payment of employees.

We perform the calculations, track input tax credits, and file all GST/HST returns to ensure your business and finances remain compliant.

We have professional financial statements that meet all industry standards, making them suitable for business enterprises that require no formal audit.

We monitor your performance on the invested fund, capital gains, and income, keeping our records straight and compliant with your portfolio.

When you partner with Aone, you are partnering with one of the top three accounting firms in Ottawa, providing trustworthy service as well as expert support in all matters of your finances.

Finance management in a modern, competitive world has become a situation that is becoming increasingly challenging for many business establishments throughout Ottawa. Whether it comes to keeping abreast of bookkeeping and payroll or dealing with Ottawa tax filings and GST/HST, it is a complicated and time-consuming task. It is not always possible to hire full-time employees, and even with a team that has extensive experience, it can be challenging to stay up-to-date with CRA regulations.

Outsourcing is a convenient and affordable alternative to hiring experts, offering higher accuracy and allowing business owners more time to focus on development. Through Aone Outsourcing, an entire range of customized accounting services in Ottawa, such as bookkeeping, payroll, tax returns, and accounting for investment, will be available to you.

Accounting outsourcing involves the outsourcing of financial functions, including bookkeeping, payroll, tax preparation, and the compilation of financial statements. You transfer your data safely through cloud-based opportunities, and the provider handles all those accounting tasks remotely, leaving you compliant and on the cutting edge.

Cost Reduction: Eliminate recruitment, training, and infrastructure costs.

Expert Support: Get access to qualified individuals specializing in CRA compliance.

Time Efficiency: When in business, concentrate on doing business and leave financial matters to professionals.

Better Accuracy: Minimize errors in tax filing, payroll, and bookkeeping.

Scalability: Scale services down or up with ease according to business requirements.

Outsourcing helps companies save 30-60 percent compared to hiring in-house employees on a full-time basis. You skip on having to pay salaries and benefits, software license purchases, and training, among others, without even missing expert-based accounting support in Ottawa.

The commonly employed options for outsourcing pricing in Canada include fixed price, cost-plus, resource-based, or time-and-materials. The cost of small business services, such as bookkeeping or payroll services, is generally averaged at CAD 5,000-$15,000 a month, based on the number of transactions you have on those services and the charges per billing cycle of the provider you engage.

Absolutely. Outsourcing is a legitimate business practice in Canada that has been employed in standard service contracts. Canada also has robust standards, laws, and data protection measures, making it a suitable location for outsourcing financial activities such as bookkeeping, payroll, and tax services.

Accounting functions have the highest rate of outsourcing, encompassing the transaction-intensive aspects of the accounting cycle, such as bookkeeping, accounts payable/receivable, and tax accounting. Such tasks are time-consuming and require accuracy every time; hence, they are perfect candidates for outsourcing.