GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Operating a business in Montreal presents numerous opportunities, yet it also has specific financial and compliance requirements. As a freelancer, a startup or an established small business, you will find it hard to take care of day-to-day operations and manage your money all at the same time and more so without the help of the best accounting firms in Montreal.

Among the most significant hindrances is working in the bilateral taxation systems. The taxes in Montreal have complicated tax filing further because they fall under both Federal and Quebec requirements, which also exposes Montreal tax filers to the dangers of missed deadlines and substantial tax liabilities. The fact that changes to the regulations that CRA and Revenu Québec continue to make in footing each other only makes the entire process of staying compliant even more complex, as constant care must be taken to avoid breaching the requirements.

Another issue is manual operations, especially on payroll services in Montreal. The vast majority of businesses lack automated payroll processing systems, forcing their employees to endure inefficiency, delayed payments, and untimely frustrations. Even the simplest Montreal payroll processes can become cumbersome without streamlined systems in place.

Bookkeeping is not simple. Most outdated systems and uneven tracking usually leave business owners with a confusing picture of their cash flow and profits. This hampers proper decision-making, particularly when not based on professional bookkeeping services in Montreal that provide real-time reporting and accurate financial facts.

Getting professional assistance is also minimal. It is challenging to find a reliable and affordable accounting service in Montreal that small businesses can afford. Income tax preparation in Montreal and income tax filing can consume all the time of business owners, who often spend hours researching until they find a service they can trust, leaving little time for strategizing and customer handling.

Compliance, reporting, and operating requirements are putting ever more pressure on businesses in Montreal. As long as they lack streamlined systems and expertise, they may waste your time, money, and energy. However, armed with the appropriate solution, such as outsourced bookkeeping, payroll, and tax preparation services in Montreal, these obstacles can be negated, and you can concentrate on the growth of your business without hesitation.

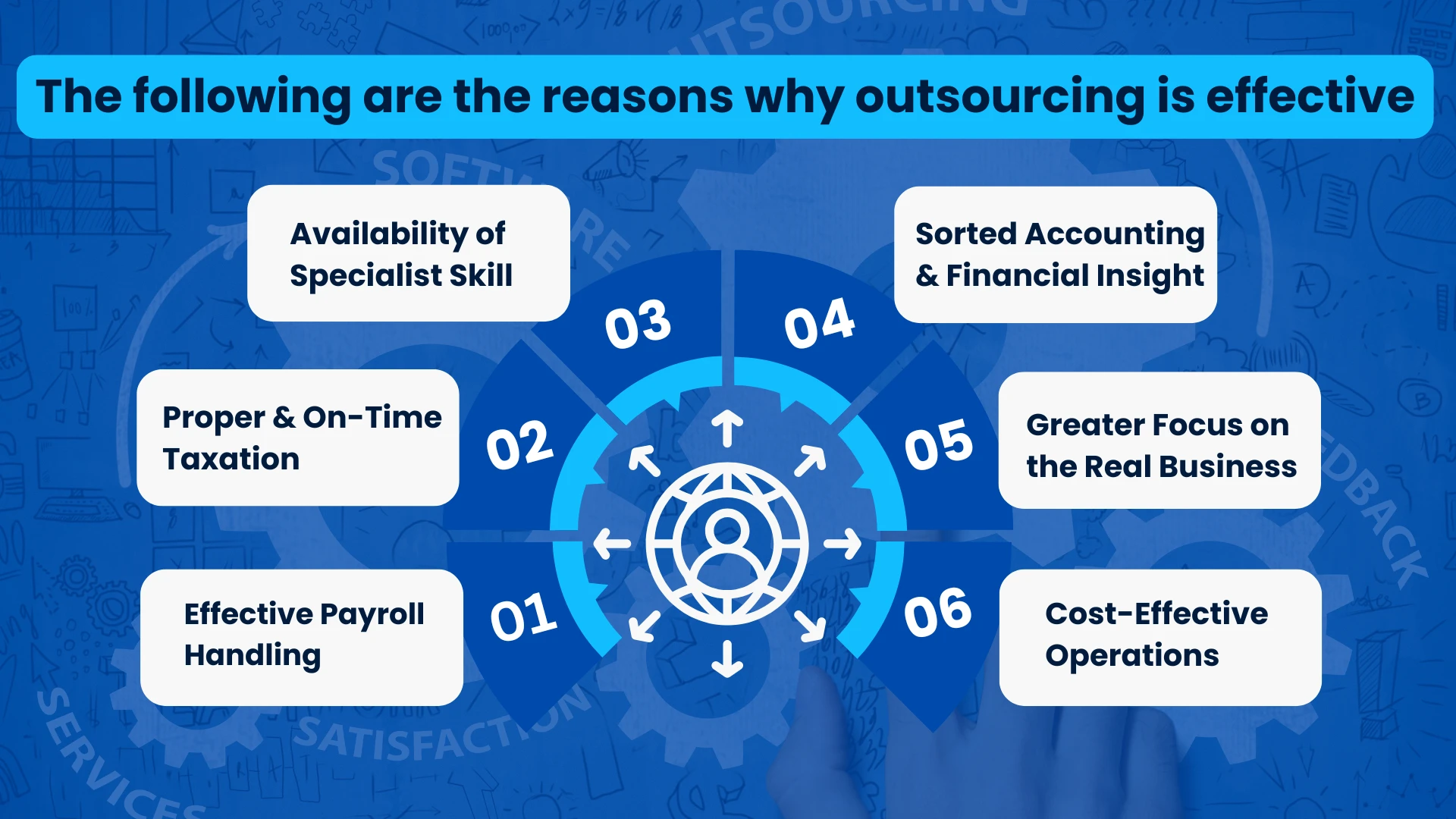

Outsourcing financial activities is increasingly being considered by businesspeople in Montreal as a reality and a sound business practice, due to the operational hurdles that businesses face. Due to a shortage of time, the growth in compliance requirements, and the increase in the costs of overhead factors, outsourcing is a reliable alternative to doing everything internally.

Outsourcing also exposes businesses to professionals who possess thorough knowledge of Canadian and Quebec rules and regulations related to payroll and tax.

There is accuracy in the preparation of Montreal income taxes and filings, as well as the avoidance of errors and penalties.

Payroll runs are made smooth, accurate, and on time with automated systems, which enhance compliance and employee satisfaction.

Current books empower business owners to make informed decisions with a clear view of their finances.

Outsourcing routine tasks will enable companies to refocus on strategic planning, customer service, and business growth.

Saving time is not the only benefit of outsourcing; it's also about taking back control, minimizing stress levels, and expanding desirably in the competitive Montreal market.

A complete array of accounting services can serve Montreal businesses to take care of their localized as well as federal financial needs. We offer services tailored to help you become compliant, minimize administrative workload, and enhance business control.

Bookkeeping Services Montreal

Run your books in the cloud and be on top of your accounting and auditing. Your books are updated as the month ends through monthly reconciliation and detailed reporting. Your financial records at the end of the fiscal year will be crisp and clean, but at the same time, ready to be filed.

Automated systems simplify payroll processing by supporting direct deposit and timely filing of T4 and RL-1 slips. The companies in question will have the assurance of full adoption of CRA and Revenu Québec compliance, as well as proper recordings and tracking of payroll data for employees.

Taxation in Quebec is complex, and it is essential to understand the dual tax system. We guarantee the timely and accurate filing of your income tax in Montreal. We assist companies in achieving their goals by ensuring they remain compliant throughout the year with GST/HST filings or corporate returns.

Firms seeking comprehensive financial management services receive full-service accounting support from us. This also offers financial reporting and forecasting, including tax planning, delivered by professionals with vast experience and knowledge in the national taxation system and the province. Our approach to detail and attention to clients has often earned us a reputation as one of the most credible accounting companies in Montreal.

Our GST services involve helping you get registered, determining the correct charges to charge, and remitting the returns on time and in the proper manner. We also provide guidelines to ensure your business complies with the GST/HST rules established by both federal and Quebec GST/HST regulations.

Devoting countless hours of time and energy to spreadsheets, tax forms, and payroll calculations can be exhausting, particularly when your business is struggling to move forward within a thriving business community like Montreal. It doesn't have to be that way.

Keeping finances in order when you have the right people on your side will be easier, quicker, and more precise. Outsourcing can help you gain the insight and freedom to focus on your core business, whether it involves bookkeeping, payroll processing, or Montreal tax filing.

Offshore accounting refers to the process of outsourcing financial accounting services, including bookkeeping, payroll processing, and tax preparation, to a foreign financial company. This enables businesses to reduce their costs while leveraging the expertise of accountants and modern technology.

The rate of offshore bookkeepers is typically between $10 and $30 per hour. Prices vary according to the complexity of services, the location where the provider is operating and the expertise provided.

Indeed, bookkeeping is a highly lucrative venture for both the service provider and the business. They can minimize mistakes, enhance the visibility of cash flow, and release internal resources, which ultimately lead to increased efficiency and cost savings in the business.

Admittedly, it is possible to do it online, using the Revenu Québec official site, as well as SQ tax software certified by Revenu Québec. It is more convenient, quicker and prevents the errors that usually occur in paper filing.

Montreal, being part of Canada, has a 5% GST (Goods and Services Tax). Moreover, the province of Quebec has a sales tax of 9.975%, known as the Quebec Sales Tax (QST), which increases the total sales tax to approximately 14.975%.

The average range of fees charged by bookkeepers in Canada is between $ 25 and $60 per hour. The rate can vary depending on the experience, certification, the complexity of the services, and whether you are hiring in-house or outsourcing.

Montreal income tax incorporates federal and provincial taxes of Quebec. The rates, when combined, may vary between 15 percent for lower incomes and more than 50 percent for higher earners on an income bracket basis, depending on the level of deductions.

Indeed, in Canada, taxes are complicated, particularly in Quebec, where there are two separate systems: federal and provincial. Many individuals and small businesses prefer to collaborate with tax experts to avoid penalties and potential tax liabilities.

When you mail your return, it is processed by either the Canada Revenue Agency (CRA) or Revenu Québec, depending on the type of return you are filing. However, these days, a majority of taxpayers have started filing electronically, as the process is quicker and confirmation is also available.