GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Ontario is an entrepreneurial and business-friendly environment for conducting business. Still, beneath the surface, an entrepreneur is a busy person with numerous financial and administrative tasks that distract them from the company they are in.

With local tax law compliance, employee payrolls, and proper financial accounting records, it is not only time-consuming but also a risk to get it wrong. What can begin as a reasonable assignment can soon escalate into time wasted in spreadsheets, government websites and following up on payment dates.

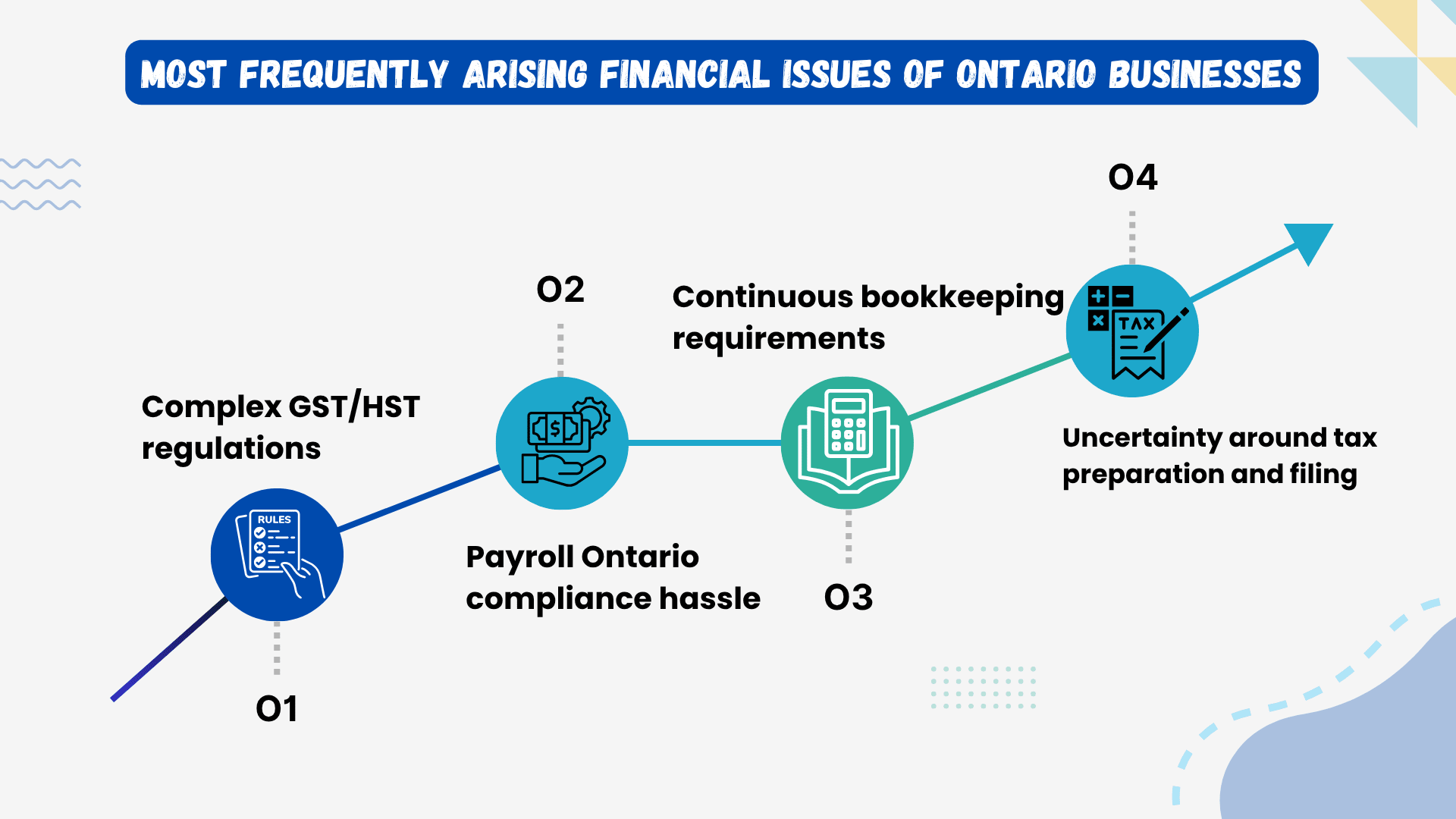

Below are some of the most frequently arising financial issues of Ontario businesses:

Complex GST/HST regulations: It is challenging to determine when to charge GST/HST and what proportion of GST/HST Ontario to apply based on your goods, services, and customer location.

Payroll Ontario compliance hassle: Whether it is determining the amount of deductions, completing T4S, and making scheduled payments or remittances to the CRA in Ontario, is much more than simply writing cheques.

Continuous bookkeeping requirements: Including day-to-day transactions, reconciliations, and monitoring of accounts payable and receivable, tend to become overwhelming for small in-house departments.

Uncertainty around tax preparation and filing: The tax policy in Ontario is constantly changing, and failure to meet a deadline or claim a deduction may result in hefty fines.

The challenges not only affect compliance but also limit your capacity to align with growth, strategy, and value delivery to your customers.

Ontario companies face pressure to keep pace with changes in tax regulations, manage payroll efficiently without incurring excessive business costs, and maintain accurate financial records while meeting operational expenses. Here, outsourcing is not only a beneficial choice but a practical business solution.

Outsourcing bookkeeping, payroll, and tax filing Ontario services is a new way for small startups in Hamilton or big firms in Toronto to labour less and do more by hiring the services of outside companies to handle these tasks.

Cost-Efficiency Without Compromising Quality

Using payroll services in Ontario or tax filing can be expensive, as hiring in-house payroll and tax officials incurs the costs of salaries, software, training, and overhead, which can accumulate quickly. Outsourcing also offers you professional help at an incredibly low price, and affordable rates that vary according to your corporate requirements.

Whether it is the reconciliation of GST/HST in Ontario or the submission of accurate income tax forms in Ontario, your business is in the hands of outsourced professionals who ensure compliance with all CRA and provincial regulations. No more guessing, lost remittances or filing omissions.

When business owners outsource their bookkeeping services and tax preparation in Ontario, they can reclaim their valuable time and focus on organizational growth, serving their customers, and strategizing business goals, rather than spending time on paperwork and the stress of compliance.

Whether you are opening new branches, hiring more employees, or approaching an audit, outsourcing provides access to payroll companies in Ontario and bookkeeping groups that can scale to your needs, on short notice.

We realize that Ontario has a unique financial environment, which is why we are at Aone Outsourcing. Whether it's understanding provincial taxes, payroll and compliance management, or growth level, our solution is tailored to the location of your business, the industry you're in, and your growth stage. This is what businesses in Ontario can count on us to do:

Correct bookkeeping is the basis of any successful business. The bookkeeping services provided by our team are professional, with a single entry to the journal and maintenance of a general ledger, as well as real-time financial statements, available in Ontario. Remain audit-ready, regulatory-compliant, and meaningfully financially-transparent, and yet without the burden of maintaining an internal team.

Cash flow is an important aspect to manage. Our accountants handle accounts payable and accounts receivable in Ontario, ensuring that your vendors are paid on time and that your accounts receivable are collected promptly. Automated invoicing, tracking of payments, and processes, we ensure that you never miss a late fee or that the operations are not disrupted.

Paying taxes in Ontario not only entails completing forms but also staying informed about changes in provincial regulations, understanding available deductions, and knowing how to comply with the CRA. We handle individual and business taxes in Ontario in a manner that ensures you receive maximum returns and that all your deadlines are met without any stress.

Whether it is calculating the wages or making deductions, our payroll services in Ontario are fully compliant with the requirements of the Ontario Employment Standards Act and the requirements of CRA. We process and manage our pay runs, T4 slips, ROEs, and summaries annually on a on-schedule and secure basis.

Are you confused about GST, HST Ontario, or both? Depending on the type of business and its location, we guarantee that it is registered, calculated, charged, and paid accordingly. Our GST/HST representation services in Ontario are beneficial in preventing overpayment, underpayment, or misfiling of a tax with the CRA.

We also provide professional compilation engagements in Ontario that are sufficient to satisfy your stakeholders, should they require a reliable financial statement prepared by CSRS 4200. These are perfect for obtaining loans, making presentations to investors or at the year-end when the need for documentation arises.

As an individual investor or a custodian of company funds, we provide investment accounting solutions in Ontario that help precisely monitor capital gains, dividends, and the performance of the investment portfolio. Gain control over reporting and reporting regulations that accompany investments.

We align all our services with Ontario standards for tax and regulatory environments, ensuring you have peace of mind and the space to grow.

Ontario has numerous bookkeeping and payroll Ontario companies to choose from; what sets us apart is our in-depth knowledge of local compliance, our dedication to accuracy, and our commitment to your growth.

This is the reason why Ontario businesses trust us:

Ontario-Centric Compliance Experience

We are also specialists in bookkeeping, payroll, and tax filing in Ontario, and we will ensure that your business is compliant with both provincial rules and regulations, as well as those of the CRA. We will provide you with the correct GST/HST filing, income tax forms, and payroll remittances. You do not have to follow Ontario's changing tax landscape because we do.

We partner with the best cloud accounting systems, such as QuickBooks, Xero, and Sage, which are specifically tailored to Canadian businesses. Our technology provides a quick, safe, and convenient way to access your Ontario tax returns, GST/HST reconciliation, payroll, and more.

Our pricing structure is simplified and modular, as we do not offer vague packages like those provided by other payroll companies in Ontario—no extra costs. There are no permanent contract deals. Simply pay the amount you use, and that's it.

As a long-time provider of accounting services in Phoenix, we understand our clients and know how to support them effectively. It could be tax preparation in Ontario or managing your payables, and you will always seek the advice of an intelligent, friendly expert, not a call center or a chatbot.

Your business data is safeguarded by adhering to strict security procedures and using GDPR-compliant tools. Your Ontario payroll, tax, and financial information is secure with us, encrypted, backed up, and only accessible to authorized staff.

When you work with Aone Outsourcing, you do not only get outsourcing of chores, but you acquire a partner who believes in your greater presence and prosperity in Ontario.

Administration of Payroll, bookkeeping, tax filing, and GST/HST reconciliation in Ontario is no reason to hamper your business. Ontario businesses must contend with issues such as complex income taxation forms, CRA timelines, and adherence to provincial requirements, which consume valuable time and resources.

At Aone Outsourcing, we make it easy by providing cost-effective, accurate, and scalable two-way solutions that are exclusively customized for the Ontario market. We will enable you to be compliant, financially stable, and time-efficient, allowing you to pursue business growth with clarity.

Small businesses, start-up companies, and growing businesses outsource with us, and you'll have fewer errors, quicker processing, and peace of mind.

Get your Free Consultation NOW!

1. How much does a bookkeeper charge in Ontario?

The cost ranges from $25 to $60 per hour or $250 to $1,000 per month, depending on the level of service. We provide tailored and affordable bookkeeping services for Ontario to meet your specific needs.

Aone Outsourcing is a reputable partner in outsourcing to the accounting firms and CPAs in Canada. We provide bookkeeping services, payroll services, tax filings, and more [email protected], enabling CPAs to reduce overhead costs, save time, and remain focused on advisory services.

A bookkeeper is a specialist who is responsible for preparing daily financial reports, including transactions, invoicing, and reconciliations. Accountants utilize this information to prepare financial statements, provide tax recommendations, and assist in making strategic decisions. We provide the two with full Ontario financial support.

No. You sign up for HST in Ontario, which is the convergence of the Federal GST and the provincial sales tax of Ontario. You should be registered if your annual revenue exceeds $ 30,000. We assist in establishing and calculating HST and Ontario reconciliation.

Ontario corporations are required to report within six months following the end of their fiscal year. Sole owners also do this by June 15, although the taxes due should be paid earlier, on April 30. We provide timely, accurate, and compliant tax filing services in Ontario to ensure adherence to regulations.

Yes. Our Ontario payroll services comply with Ontario labour laws regarding accurate deductions, remittances, and the requirements of the Ontario labour standards. We ensure that your payroll is accurate, correct, and on time, without requiring CRA intervention.